British American Tobacco (BAT) is really hurting from the new government ruling prohibiting packs below 20 sticks from being sold in the market place.

Although BAT reported better on-year results, its quarter-on-quarter performance moved sideways with new government regulations banning the sale of packets containing fewer than 20 cigarettes.

“The group’s revenue remained flat versus the previous quarter as gains from volume increase was offset by unfavourable pack size mix,” BAT said in its announcement to the local bourse.

“Consequently, profit before taxation in the current quarter was lower... compared to the preceding quarter.”

The company also said the government’s decision to raise the excise tax of three sen per cigarette on October 1 will fuel the growth of cigarette smuggling in the country.

Thomson I/B/E/S estimates BAT’s net profit for the full year ending December 31 to come in at RM726.74 million. BAT’s RM573.9 million for the nine months ended September 30 puts the company solidly on track to meet estimates.

Analysts do not provide quarterly estimates for Malaysian companies.

BAT shareholders will get another interim dividend of 64 sen to be paid out in November soon.

October 23, 2010

October 19, 2010

Budget 2011- A Tactical Blunder?

It was sad that the 2011 Budget hardly address any of the more serious issues as discussed in the New Economic Model (NEM) and its subsequent flagship programmes.

As such it comes as no surprise that the Malaysian Institute of Economic Research (MIER) continues to maintain Malaysia's economic growth forecast of 6.5 per cent for this year (2010) despite the government's revised GDP projection from 6x to 7 per cent.

Additionally, MIER was also unhappy with the smaller than expected reduction in the budget deficit projected for next year and particularly, the lack of measures to tackle high levels of household debt which it described as “unhealthy” and one of the highest in Asia.

MIER opines that the global economy will slowdown in the second half of the year given weaker global trade conditions and the ongoing sovereign debt problem in the Eurozone and that developing Asia will continue to lead global growth because of resilient domestic demand.

"There are downside risks to growth and we have based this on slowing exports and weaker sentiment in our business conditions survey," it said.

MIER also maintained its growth forecast of 5.2 per cent for next year (2011), roughly in line with the government’s projections of between 5-6 per cent.

The think tank added that if the economy slows down, borrowers could face difficulty in servicing their households loans, especially housing loans which make up the bulk of the household debt and said more loans should be channelled to productive businesses instead.

The research organisation’s Business Conditions Index (BCI) fell sharply to 104.9 in the third quarter which it noted more than offset the surge in its Consumer Sentiment Index (CSI) to 115.8.

“Other indices also painted a similar gloomy environment ahead,” said MIER.

In terms of interest rates, the institute saw no increase this year but said it would rise to 3.25 per cent to help combat inflation which it projected to be 2.2 per cent in 2010 and 2.5 per cent in 2011.

Prime Minister Datuk Seri Najib Razak said in his budget speech that the government had revised this year’s growth forecast upwards from six to seven per cent due to positive developments such as export growth of 22 per cent in the first eight months of this year and imports of capital goods which grew 18 per cent.

Najib also said that the budget deficit is expected to decline to 5.4 per cent next year from 5.6 this year, a minor reduction which some analysts said was insufficient and could affect the nation’s credit rating while others said was reasonable given the forecast of stronger economic headwinds.

Anyway,so much for a great NEM side show and veiled crystal-balling.

As such it comes as no surprise that the Malaysian Institute of Economic Research (MIER) continues to maintain Malaysia's economic growth forecast of 6.5 per cent for this year (2010) despite the government's revised GDP projection from 6x to 7 per cent.

Additionally, MIER was also unhappy with the smaller than expected reduction in the budget deficit projected for next year and particularly, the lack of measures to tackle high levels of household debt which it described as “unhealthy” and one of the highest in Asia.

MIER opines that the global economy will slowdown in the second half of the year given weaker global trade conditions and the ongoing sovereign debt problem in the Eurozone and that developing Asia will continue to lead global growth because of resilient domestic demand.

"There are downside risks to growth and we have based this on slowing exports and weaker sentiment in our business conditions survey," it said.

MIER also maintained its growth forecast of 5.2 per cent for next year (2011), roughly in line with the government’s projections of between 5-6 per cent.

The think tank added that if the economy slows down, borrowers could face difficulty in servicing their households loans, especially housing loans which make up the bulk of the household debt and said more loans should be channelled to productive businesses instead.

The research organisation’s Business Conditions Index (BCI) fell sharply to 104.9 in the third quarter which it noted more than offset the surge in its Consumer Sentiment Index (CSI) to 115.8.

“Other indices also painted a similar gloomy environment ahead,” said MIER.

In terms of interest rates, the institute saw no increase this year but said it would rise to 3.25 per cent to help combat inflation which it projected to be 2.2 per cent in 2010 and 2.5 per cent in 2011.

Prime Minister Datuk Seri Najib Razak said in his budget speech that the government had revised this year’s growth forecast upwards from six to seven per cent due to positive developments such as export growth of 22 per cent in the first eight months of this year and imports of capital goods which grew 18 per cent.

Najib also said that the budget deficit is expected to decline to 5.4 per cent next year from 5.6 this year, a minor reduction which some analysts said was insufficient and could affect the nation’s credit rating while others said was reasonable given the forecast of stronger economic headwinds.

Anyway,so much for a great NEM side show and veiled crystal-balling.

Labels:

Perspectives

October 09, 2010

KL Getting Less Globalised?

Malaysia’ capital city has been downgraded. It dropped eight spots to 48 in a ranking of the world’s most global cities by international management consulting firm AT Kearney.

Topping the list of the 2010 Global Cities index were New York, London, Tokyo and Paris. This index assessed 65 major cities based on the strength of their business, human capital, political, cultural and information assets.

The other Asia Pacific cities that made the top ten were Hong Kong - 5, Singapore - 8, Sydney – 9 and Seoul - 10.

Spurred by the increasing competition between cities which is contributing to a brain drain, government think tank Pemandu, is driving an initiative to make the Greater KL region a world class city.

Its stated goal is to propel KL to the top 20 in the world in both liveability and economic growth by 2020.

The AT Kearney global cities ranking shows however, the amount of catching up that Kuala Lumpur has to do and that other cities have the same idea and are not standing still.

In terms of liveability, KL ranks just 79th out of 130 cities in the Economist Intelligence Unit’s 2010 ranking of easiest places to live and was stagnant at 75th in the Mercer study of best places to live from 2006-2009.

The city also failed to make the list of the top 100 most innovative cities with strong cultural and human infrastructure and global links as assessed by Australian innovation consultancy firm 2thinknow.

Among initiatives planned for KL under the Economic Transformation Programme include a new MRT system to enhance public transportation, rehabilitation of the city’s polluted rivers, more green space, a high speed rail link to Singapore, improved pedestrian linkages and a more vibrant and seamless shopping belt. It is hoped that the better conditions will help attract top talent live in the city, whose population is expected to soar to 10 million in 2020 from 6 million currently.

The city’s attractiveness however is hampered by an absence of world class universities, relatively low salaries, lack of major cultural and outdoor attractions, lack of orderliness and poor maintenance, low levels of sophistication, creeping urban sprawl, crime, unhygienic conditions and traffic congestion.

The next few years will be critical for KL's ambitions to be a world class city as the AT Kearney report notes that the gap between the top cities and those who rank at the “tail” end is increasing.

KL’s 48th position puts it behind Bangkok – 36 and Taipei – 39 but slightly ahead of Manila – 51, Jakarta – 53 and Ho Chi Minh city – 61.

AT Kearney noted that global cities are the urban elite and are shaping the future with new deals and ideas.

“Global cities are where you go to do business, yes, but also to see the greatest art, hear the greatest orchestras, learn the latest styles, eat the best food and study in the finest universities,” said the report.

“They have global corporations. But they also have think tanks, jazz bars and broadband. In a word, they have clout.”

So, what do you think of this index?. A load of horse dung?

Topping the list of the 2010 Global Cities index were New York, London, Tokyo and Paris. This index assessed 65 major cities based on the strength of their business, human capital, political, cultural and information assets.

The other Asia Pacific cities that made the top ten were Hong Kong - 5, Singapore - 8, Sydney – 9 and Seoul - 10.

Spurred by the increasing competition between cities which is contributing to a brain drain, government think tank Pemandu, is driving an initiative to make the Greater KL region a world class city.

Its stated goal is to propel KL to the top 20 in the world in both liveability and economic growth by 2020.

The AT Kearney global cities ranking shows however, the amount of catching up that Kuala Lumpur has to do and that other cities have the same idea and are not standing still.

In terms of liveability, KL ranks just 79th out of 130 cities in the Economist Intelligence Unit’s 2010 ranking of easiest places to live and was stagnant at 75th in the Mercer study of best places to live from 2006-2009.

The city also failed to make the list of the top 100 most innovative cities with strong cultural and human infrastructure and global links as assessed by Australian innovation consultancy firm 2thinknow.

Among initiatives planned for KL under the Economic Transformation Programme include a new MRT system to enhance public transportation, rehabilitation of the city’s polluted rivers, more green space, a high speed rail link to Singapore, improved pedestrian linkages and a more vibrant and seamless shopping belt. It is hoped that the better conditions will help attract top talent live in the city, whose population is expected to soar to 10 million in 2020 from 6 million currently.

The city’s attractiveness however is hampered by an absence of world class universities, relatively low salaries, lack of major cultural and outdoor attractions, lack of orderliness and poor maintenance, low levels of sophistication, creeping urban sprawl, crime, unhygienic conditions and traffic congestion.

The next few years will be critical for KL's ambitions to be a world class city as the AT Kearney report notes that the gap between the top cities and those who rank at the “tail” end is increasing.

KL’s 48th position puts it behind Bangkok – 36 and Taipei – 39 but slightly ahead of Manila – 51, Jakarta – 53 and Ho Chi Minh city – 61.

AT Kearney noted that global cities are the urban elite and are shaping the future with new deals and ideas.

“Global cities are where you go to do business, yes, but also to see the greatest art, hear the greatest orchestras, learn the latest styles, eat the best food and study in the finest universities,” said the report.

“They have global corporations. But they also have think tanks, jazz bars and broadband. In a word, they have clout.”

So, what do you think of this index?. A load of horse dung?

Labels:

Perspectives

October 08, 2010

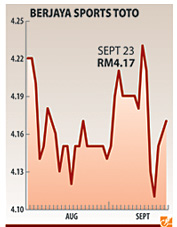

BJ Toto: Sliding to Mediocrity

OSK Research has maintained its "buy" call on Berjaya Sports Toto Bhd, but lowered its target price on the gaming company to RM4.50.

This is after BToto's (1562) first-quarter results that came below expectations.

"BToto's first-quarter numbers fell below expectations on higher prize payouts, pool betting duties and corporate taxes. However, the group remains committed to maintaining its high payout policy, as evident from the 167 per cent net dividend payout ratio in the first quarter."

Nonetheless, OSK Research is trimming its dividend payout assumption in line with the reduction in its earnings estimates for fiscal 2011 and 2012, for which it also projects a dividend payout of 95 and 90 per cent respectively.

The research house expects BToto's revenue to pick up in the upcoming quarters.

"The group's revenue shrank by a marginal 2.7 per cent quarter-on-quarter versus the traditionally larger seasonal decline due to a strong pick-up in sales from its 6/58 lotto games, for which the record jackpot has snowballed from the initial minimum of RM8.8 million to the RM44.9 million currently.

"With the estimated average sales volume of its lotto games coming in at a higher RM2 million per draw in the second quarter of financial year 2011 versus RM1.4 million in the first quarter, we expect overall quarter-on-quarter sales to pick up as a bigger jackpot traditionally generates buying interest that spills over to its core 4D games," it said.

OSK's previous target price for BToto was RM5.20. It's current recommendation is for a buy, target price at RM4.50

MY TAKE:

As BToto price has been hovering below the RM4.20 price, it may spurt up but much depends on the strength of the overall market to buoy it's price.

This is after BToto's (1562) first-quarter results that came below expectations.

"BToto's first-quarter numbers fell below expectations on higher prize payouts, pool betting duties and corporate taxes. However, the group remains committed to maintaining its high payout policy, as evident from the 167 per cent net dividend payout ratio in the first quarter."

Nonetheless, OSK Research is trimming its dividend payout assumption in line with the reduction in its earnings estimates for fiscal 2011 and 2012, for which it also projects a dividend payout of 95 and 90 per cent respectively.

The research house expects BToto's revenue to pick up in the upcoming quarters.

"The group's revenue shrank by a marginal 2.7 per cent quarter-on-quarter versus the traditionally larger seasonal decline due to a strong pick-up in sales from its 6/58 lotto games, for which the record jackpot has snowballed from the initial minimum of RM8.8 million to the RM44.9 million currently.

"With the estimated average sales volume of its lotto games coming in at a higher RM2 million per draw in the second quarter of financial year 2011 versus RM1.4 million in the first quarter, we expect overall quarter-on-quarter sales to pick up as a bigger jackpot traditionally generates buying interest that spills over to its core 4D games," it said.

OSK's previous target price for BToto was RM5.20. It's current recommendation is for a buy, target price at RM4.50

MY TAKE:

As BToto price has been hovering below the RM4.20 price, it may spurt up but much depends on the strength of the overall market to buoy it's price.

Labels:

Stocks

Axiata:Overseas Expectations

The future earnings of Axiata according to MIDF Research will come from its overseas market, especially Indonesia and Bangladesh.

The two countries contributed 39.3 per cent and 7.6 per cent to Axiata's first-half 2010 revenue, while growing 49.3 per cent and 24.8 per cent year-on-year respectively.

So MIDF is maintaining its call for Axiata due to its diversified exposure and growth potential, especially in Indonesia and Bangladesh.

Boost will particularly come from its associate in Singapore, M1, following Singapore's Infocomm Development Authority announcement that it was allotting additional spectrum to the three existing telecommunications companies and are foregoing the auction of a fourth 3G spectrum.

The maintained buy, target price RM5.30.

The two countries contributed 39.3 per cent and 7.6 per cent to Axiata's first-half 2010 revenue, while growing 49.3 per cent and 24.8 per cent year-on-year respectively.

So MIDF is maintaining its call for Axiata due to its diversified exposure and growth potential, especially in Indonesia and Bangladesh.

Boost will particularly come from its associate in Singapore, M1, following Singapore's Infocomm Development Authority announcement that it was allotting additional spectrum to the three existing telecommunications companies and are foregoing the auction of a fourth 3G spectrum.

The maintained buy, target price RM5.30.

Labels:

Stocks

October 02, 2010

Gifts for the Greeks:China to the Rescue

Fools rushed in where Angels fear to tread.

But is it in this case? Do the Chinese know something that the world doesn't?

Or they playing Russian roulette?

China offered today to buy Greek government bonds in a show of support for the country whose debt burden triggered a crisis for the euro zone and required an international bailout.

Premier Wen Jiabao made the offer at the start of a two-day visit to the crisis-hit country where he says he expects to expand ties in all areas.

“With its foreign exchange reserve, China has already bought and is holding Greek bonds and will keep a positive stance in participating and buying bonds that Greece will issue,” Wen said, speaking through an interpreter.

“China will undertake a great effort to support euro zone countries and Greece to overcome the crisis.”

Greece needs foreign investment to help it fulfil the terms of a €110 billion (RM463.13 billion) bailout. This rescued it from bankruptcy in May but also imposed strict austerity measures, deepening its recession.

Greece, which has been raising only short-term loans in the debt market, has said it wants to return to markets some time next year to sell longer-term debt, although the EU/IMF package allows it to wait until 2012.

“I am convinced that with my visit to Greece our bilateral relations and cooperation in all spheres will be further developed,” Wen told Greek Prime Minister George Papandreou earlier in the day.

Greece and China pledged to stimulate investment in a memorandum of understanding and private companies signed a dozen deals in areas like shipping, construction and tourism.

Isn't China playing its overdue role in helping globalisation to prosper?

I think so.

Labels:

Economy

September 29, 2010

Casual, Part-time or Full-time

Effectively on October 1, part-time workers will be legally defined as those who work between 30% and 70% of full-time employees' working hours.

They will also be eligible for incentives in the form of insurance and other rights such as annual leave, sick leave and rest day as well as overtime pay.

As an example-

"If the normal working hour is eight hours a day, for part-time workers, their working hour is between 2.4 hours and 5.6 hours a day."

As with most things, there are exclusions.

Employees working from home or those involved in tele-working (telecommuting) is not included.

This move is expected to attract some 6.8 million latent workforce comprising mostly housewives, including single mothers, university students, retirees as well as the disabled into the labour market.

Those working less than 30% of the normal working hours are defined as casual workers and not included under the new regulations.

As for those working more than 70% of the normal working hours, they are considered full-time workers and covered under the Employment Act 1955.

"The reason for this is we want to avoid people who work casually to come under the ambit of this regulation as this would create problems for the employers.

On the issue of rest days, part-time workers are eligible for it if they work at least five days or 20 hours a week and they are also entitled to the Employees’ Provident Fund and SOCSO coverage on a pro rate basis.

So, for those who are working from 30% and 70% of normal working hours,do know your rights under

the new Work Regulations (Part Time Workers) 2010.

They will also be eligible for incentives in the form of insurance and other rights such as annual leave, sick leave and rest day as well as overtime pay.

As an example-

"If the normal working hour is eight hours a day, for part-time workers, their working hour is between 2.4 hours and 5.6 hours a day."

As with most things, there are exclusions.

Employees working from home or those involved in tele-working (telecommuting) is not included.

This move is expected to attract some 6.8 million latent workforce comprising mostly housewives, including single mothers, university students, retirees as well as the disabled into the labour market.

Those working less than 30% of the normal working hours are defined as casual workers and not included under the new regulations.

As for those working more than 70% of the normal working hours, they are considered full-time workers and covered under the Employment Act 1955.

"The reason for this is we want to avoid people who work casually to come under the ambit of this regulation as this would create problems for the employers.

On the issue of rest days, part-time workers are eligible for it if they work at least five days or 20 hours a week and they are also entitled to the Employees’ Provident Fund and SOCSO coverage on a pro rate basis.

So, for those who are working from 30% and 70% of normal working hours,do know your rights under

the new Work Regulations (Part Time Workers) 2010.

Labels:

Perspectives

Subscribe to:

Comments (Atom)