For a moment in time, Whitney was with us. She leaves us with more sweet that bitter memories. Here is her rendition of 'The Greatest Love of All".

February 13, 2012

Celine Dion In Concert

Celine in concert is an experience. If only, it is the real thing. However, a HD video of the event is second best.

Here, enjoy!

Here, enjoy!

Labels:

Melody

Supermax Corporation -New Target Price

Some More Upside

Fresh after its recent 1:1 bonus issue, Supermax Corporation (Supermax)continues to get market support. Supermax is now trading ten sen down at RM2.09 from the ex-price of RM2.19.

A research house, OSK Research continues to be bullish about the rubber gloves sector,selecting Supermax as its top pick. The potential target price envisaged is RM2.75.

Why Supermax?

OSK likes the company because of its attractive valuation and the fact that it operates in a recession-resilient industry.

While there have been isolated cases of bird flu in Asia currently, health care MNCs are beginning to gradually stock up rubber gloves to avoid buying them at "cut throat" price should a pandemic breaks out.

The risks to its upside potential are the continuing high cost of rubber supported artificially by both the Indonesian and Malaysian governments and the rising ringgit.

Thailand has also meanwhile approved a plan to increase the price of locally-grown natural rubber to THB120 (RM11.84)/kg through the Bank of Agriculture and Agricultural Cooperatives-offering soft loans of THB5bn to local agricultural institutes and another THB10bn soft loan to the Rubber Estate Organization, both at zero per cent interest to help them purchase natural rubber from local rubber farmers.

Intervention was necessary because of poor rubber prices arising from the global economic slowdown; the flooding crisis in Thailand which had temporarily suspended its production of automobiles and parts and the slower automotive growth in China which in turn slowed down its purchase of Thai natural rubber and instead had switched to the cheaper Indonesian rubber.

Sans all these support schemes, the natural forces of demand and supply will determine rubber and latex prices.

Latex price are expected to stay above RM7 in the shorter term.

While the scenario is not great, it remains good for Supermax to continue to perform well.

Labels:

Stocks

Betting on BAT

Riding High

Rolling in the Profits

Despite so many anti-smoking campaigns world-wide and exorbitant tax levy, most tobacco company counters continue to go up. Individuals actually find it very hard to own tobacco shares anywhere in the development world. The same is going to happen to Malaysia.

Look at the way British American Tobacco shares are going upwards,it is now very difficult for a retail player to purchase a 1000 shares at today's going price of RM51.50 per share. At best, you would have to cough out RM5,150 for a token 100 units of it.

BAT is certainly a good counter and pays absolutely beautiful dividends. Ask any minority shareholder and he will tell you that the share has been good to him with its bumper dividend pay-out every now and then. I will delve a little bit on BAT's dividend in another posting.

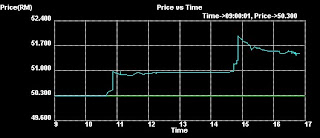

After a lull from the beginning of the year where its shares ranged from just below RM50.00, today is one break-out day. From RM50.30 , it shot passed up to almost touch RM52.00. One lot was done at RM51.98 and another at RM51.90. A dozen lots were contracted at RM51.88 before weak sellers came out from the woodwork to sell the counter down. Before the market ended, massive buying appeared out of nowhere. Some 69,500 shares changed hands during the last hour or so. This is equivalent to 51% of all volume traded.

Price-wise BAT shares have soared today by 2.4%.

Why is BAT flying like crazy?

Is it being bought by institutional buyers from overseas as a proxy to a strengthening ringgit? Or are they bought by local funds, a delayed January effect response?

Maybe another super dividend is in store as BAT has time and again been giving shareholders sweet surprises.

There is also that possibility that a bonus may be given or a share split might be in the offing.

Finishing Strong! at RM51.50

Whatever the reason, BAT is one might good counter to watch and to invest.

Labels:

Stocks

Subscribe to:

Comments (Atom)