OSK Research has maintained its "buy" call on Berjaya Sports Toto Bhd, but lowered its target price on the gaming company to RM4.50.

This is after BToto's (1562) first-quarter results that came below expectations.

"BToto's first-quarter numbers fell below expectations on higher prize payouts, pool betting duties and corporate taxes. However, the group remains committed to maintaining its high payout policy, as evident from the 167 per cent net dividend payout ratio in the first quarter."

Nonetheless, OSK Research is trimming its dividend payout assumption in line with the reduction in its earnings estimates for fiscal 2011 and 2012, for which it also projects a dividend payout of 95 and 90 per cent respectively.

The research house expects BToto's revenue to pick up in the upcoming quarters.

"The group's revenue shrank by a marginal 2.7 per cent quarter-on-quarter versus the traditionally larger seasonal decline due to a strong pick-up in sales from its 6/58 lotto games, for which the record jackpot has snowballed from the initial minimum of RM8.8 million to the RM44.9 million currently.

"With the estimated average sales volume of its lotto games coming in at a higher RM2 million per draw in the second quarter of financial year 2011 versus RM1.4 million in the first quarter, we expect overall quarter-on-quarter sales to pick up as a bigger jackpot traditionally generates buying interest that spills over to its core 4D games," it said.

OSK's previous target price for BToto was RM5.20. It's current recommendation is for a buy, target price at RM4.50

MY TAKE:

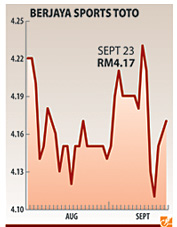

As BToto price has been hovering below the RM4.20 price, it may spurt up but much depends on the strength of the overall market to buoy it's price.

October 08, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment