Was there a push or was it a genuine buyer at RM34.80? That we may never know for sure.

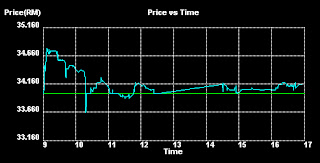

What I saw in the morning session before the EGM scheduled at 2 pm is that buying pressure has receded and bargain hunters are stacking up; pulling prices down. Most stock were done in the RM34.60-RM34.70 price range.

By 11 am, the price of the stock has dipped below RM34.00 for the second time falling as much as 34 sen at once instance.

Now it is just playing limbo rock below the RM34.00 price level and sitting at the price plateau of RM34.00 and some occasional price spurts has brought it to positive territory.

Let us see how it will settle down at the 12.30 trading break.

Looking back,it can be seen that confidence in the stock stayed at an upbeat bias as the stock transcended the psychological RM34.00 mark. Subsequently it see-sawed between RM34.04 and RM34.16 finishing at at RM34.16 for another 16 sen gain. Paltry but significant as the stock has now been approved for splitting.

Ass the time-table goes, the share will go ex on 21 November. Those shareholders who are on the company's register at 5 pm on 23 November will get the divided shares into their respective CDS by day-end.

After that, it will be dependent on market forces and perception of the historical RM0.01 sen share may give Digi a brand new image at the single ringgit league once more.

Let's look forward to Thursday 24 November 2011.

November 08, 2011

Hitting RM34

Somehow I have a gut feeling that someone is benchmarking the stock price of Digi before the split.

Some stock analyst had forecasted that Digi will go ex at RM3.40. So true to form, it burst the banks and headed beyond to RM34.22; pulling back comfortably to perched at RM34.00 at the day's close. As far as the mission is concerned, they did their job pretty well as the price breached RM34.00.

Anything more will be on its own steam.

Tomorrow, at the EGM, the share will officially be endorsed for a share split from its current 10 sen par to become a 1 sen par share. Theoretically, based on today's price, the price of RM3.40 per share brings a honourable premium of RM3.39 sen.

So let us see the price trajectory of this counter until Digi ex-split at the end of November.

Fantastic!

Some stock analyst had forecasted that Digi will go ex at RM3.40. So true to form, it burst the banks and headed beyond to RM34.22; pulling back comfortably to perched at RM34.00 at the day's close. As far as the mission is concerned, they did their job pretty well as the price breached RM34.00.

Anything more will be on its own steam.

Tomorrow, at the EGM, the share will officially be endorsed for a share split from its current 10 sen par to become a 1 sen par share. Theoretically, based on today's price, the price of RM3.40 per share brings a honourable premium of RM3.39 sen.

So let us see the price trajectory of this counter until Digi ex-split at the end of November.

Fantastic!

Labels:

Stocks

YTL Corp-Excitingly mischievous

On the GLC-Non GLC divide, one company continue to up-end almost everyone.

Perhaps Robert Kuok'e empire rule supreme. Perhaps Genting Highland Group is a formidable adversary.

But right there before our very eyes-there is the looming YTL Group helmed by the founder and his financially savvy son.

I was just looking at the reserves and cash in hand of YTL in their latest Annual report 2011 posted on Bursa KL's website this morning.

What I found interesting is that the reserves have been rising rapidly even more dramatic than the current flood waters in Bangkok.

Up to mid-2011,the fixed deposit of YTL has risen by another RM971 million since 2010. Extrapolating forward, before the year is out, additional fixed deposit should have crossed the RM1.2 billion mark by then

Combining deposit and cash in hand and bank balance, the total amount at the disposal of YTL stands close to RM12.24 billion as at mid 2011; and that my friend, is plenty of mucho dinero.

So what does a cash rich company do? Waste it as inflation devour its value? No, besides hedging it against currencies and other investment such as gold , it must do sometime about the cash horde.

As the say, an idle cash horde is a devil's playground and so good old Francis is watching out on how to make more money and more money.

What do you think he can do?

Well, for one-he is waiting for the green-light to build the KL-Singapore high speed train. Then there is always the next phase for his 4G telephony trajectory. As YTL Corp has sold most of its real estate to STAREIT or to YTL Land and Development, it is now a plenary company for strategic takeovers and tactical pursuits.

In the meanwhile,since its Treasury share accumulation is closing to the 7% mark, it may just distribute the shares generously to its loyal shareholders and start accumulating again once they obtain the renewal from its shareholders on 29 November.

The current share price is RM1.50- about the same price when it share split from 1 to 5 shares.

All in all, YTL Corp is proving to be one interesting company to watch.

Perhaps Robert Kuok'e empire rule supreme. Perhaps Genting Highland Group is a formidable adversary.

But right there before our very eyes-there is the looming YTL Group helmed by the founder and his financially savvy son.

I was just looking at the reserves and cash in hand of YTL in their latest Annual report 2011 posted on Bursa KL's website this morning.

What I found interesting is that the reserves have been rising rapidly even more dramatic than the current flood waters in Bangkok.

Up to mid-2011,the fixed deposit of YTL has risen by another RM971 million since 2010. Extrapolating forward, before the year is out, additional fixed deposit should have crossed the RM1.2 billion mark by then

Combining deposit and cash in hand and bank balance, the total amount at the disposal of YTL stands close to RM12.24 billion as at mid 2011; and that my friend, is plenty of mucho dinero.

So what does a cash rich company do? Waste it as inflation devour its value? No, besides hedging it against currencies and other investment such as gold , it must do sometime about the cash horde.

As the say, an idle cash horde is a devil's playground and so good old Francis is watching out on how to make more money and more money.

What do you think he can do?

Well, for one-he is waiting for the green-light to build the KL-Singapore high speed train. Then there is always the next phase for his 4G telephony trajectory. As YTL Corp has sold most of its real estate to STAREIT or to YTL Land and Development, it is now a plenary company for strategic takeovers and tactical pursuits.

In the meanwhile,since its Treasury share accumulation is closing to the 7% mark, it may just distribute the shares generously to its loyal shareholders and start accumulating again once they obtain the renewal from its shareholders on 29 November.

The current share price is RM1.50- about the same price when it share split from 1 to 5 shares.

All in all, YTL Corp is proving to be one interesting company to watch.

Labels:

Stocks

Subscribe to:

Comments (Atom)