Ananda Krishnan is going for his third major corporate exercise in less than a year, this time involving the privatisation of Measat Global Bhd – at a cash offer price of RM4.20 or about RM668mil.

In a statement to Bursa Malaysia yesterday, Measat said Measat Global Network Systems Sdn Bhd, the entity controlled by Ananda, intended to undertake a conditional takeover to acquire all the shares in Measat not already held by Measat Global Network Systems for RM4.20 cash per share.

“The board has deliberated on the notice of the takeover offer and does not intend to seek an alternative person to make a takeover offer of the shares,” Measat said.

It received the notice of the takeover offer from CIMB Investment Bank and Maybank Investment Bank Bhd yesterday.

Trading in Measat, which last traded at RM3.80, and another of Ananda’s companies, Tanjong plc, was suspended yesterday ahead of the announcement.

Based on Bloomberg data, as at April 26, 2010, Ananda owned 59.56% of Measat Global through Measat Global Network Systems.

Based on the offer price of RM4.20, the proposed deal works out to about RM668mil for the remaining 40.44% equity Measat Global Network Systems does not own in Malaysia‘s sole licensed regional satellite system.

Sources said the decision was made after considering the huge capital that needs to be ploughed into Measat going forward, estimated at some US$1bil over the course of the next two to three years.

Said a source close to the proposed deal: “Things are changing so fast. Once the company puts up the infrastructure and builds the satellite, it takes about eight to nine years to repay the debt.

“About three to four years after, those satellites need to be replaced. It’s a high capital-intensive business and these days, we need more powerful satellites.

“The company still needs to bring in new capital and find ways to activate and synergise the orbital slots. It’s a wonderful opportunity for Measat to emerge as a global satellite entity which is substantially Malaysian-owned,” said the source.

With emphasis on that, it is believed that the company may be considering a possible equity tie-up with a foreign strategic partner.

“There are so many opportunities to create huge capacity. It’s not just about consolidation for capital requirement but expansion of business opportunities,” said the source.

Measat said the offer was conditional upon it being accepted by shareholders of not less than nine-tenths or 90% in the nominal value of the shares not already owned by Measat as well the consent or approval of relevant parties, if required.

The offer is valid for 60 days from the date of posting of the offer document, failing which the offer shall lapse and all acceptances shall be returned to parties who have accepted the offer.

The posting of the offer document would be within 21 days from the date of yesterday’s notice, Measat said.

Measat Global Network Systems does not intend to maintain the listing status of Measat in the event it is unable to comply with the required 20% shareholding spread of Measat’s issued and paid-up capital as a result of acceptances received pursuant to the offer.

When Astro All Asia Networks plc’s privatisation plans were revealed in March, Measat’s share price surged on expectations that it would be taken private.

I guess Ananda has found a willing buyer or strategic partner that will provide the funding for development while he reaps off his profit.

As usual,the minority share-holders are not given the benefit of the Section 108 tax credits.

What a shame.

July 28, 2010

July 26, 2010

Low FDI: Not Necessarily Bad

Top banker Datuk Seri Nazir Razak today cautioned that the 2009 plunge in Malaysia’s foreign direct investment (FDI) needed to be studied carefully before jumping to conclusions.

A United Nations report showed that the once-roaring Asian Tiger’s FDI plunged 81 per cent last year, going below even the Philippines — long considered South East Asia’s basket case economy.

“It doesn’t mean that the net investment flow is lower, is necessarily bad,” the CIMB Group managing director and chief executive told reporters here.

“Look at the quality of the investments and look at the facts in terms of the timing of investments.

“It could be some delays. It could be a big, lumpy Malaysian investment overseas that distorts the net number,” added Nazir, who is also the younger brother to Prime Minister Datuk Seri Najib Razak.

He said cited CIMB and Maybank’s “huge” investments into Indonesia as possible factors that contributed to lower FDI figures so far this year.

“Is that a bad thing? It’s a good thing because, in the long term, it is beneficial for Malaysia that Maybank invests and earns return from Indonesia,” he said.

“So I don’t think we should be jumping and getting overexcited about this investment data that’s come out.”

Najib has come under fire from opposition parties for Malaysia’s lacklustre FDI rates, which have fallen faster than regional counterparts such as Singapore and China even while capital outflows dampened private domestic investment.

The World Foreign Investment Report (WIR) 2010 released by the United Nations showed that FDI in Malaysia plunged 81 per cent last year, trailing behind countries like the Philippines, Vietnam, Thailand, Indonesia and Singapore.

The report revealed that Malaysia suffered a large 81.1 per cent drop in FDIs compared to far healthier figures in Thailand (30.4 per cent), Vietnam (44.1 per cent) and Indonesia (44.7 per cent).

In May, Minister of International Trade and Industry Mustapa Mohamed announced that investments in the country for Q1 2010 amounted to RM5.2 billion.

FDIs made up RM3.2 billion of this total, with Singapore, Taiwan and Japan being the biggest contributors.

Mustapa said the investment amount was still relatively low against the total amount of RM32.6 billion in investments received last year.

Najib has been trying to lift Malaysia’s profile as a destination for foreign investment to help the country achieve an average GDP growth of at least 6 per cent per annum over the next five years.

However, his administration has insisted that the GDP growth target is still achievable despite warning that the economy may slow down in the second half of the year due to external factors.

“It doesn’t mean that the net investment flow is lower, is necessarily bad,” the CIMB Group managing director and chief executive told reporters here.

“Look at the quality of the investments and look at the facts in terms of the timing of investments.

“It could be some delays. It could be a big, lumpy Malaysian investment overseas that distorts the net number,” added Nazir, who is also the younger brother to Prime Minister Datuk Seri Najib Razak.

He said cited CIMB and Maybank’s “huge” investments into Indonesia as possible factors that contributed to lower FDI figures so far this year.

“Is that a bad thing? It’s a good thing because, in the long term, it is beneficial for Malaysia that Maybank invests and earns return from Indonesia,” he said.

“So I don’t think we should be jumping and getting overexcited about this investment data that’s come out.”

Najib has come under fire from opposition parties for Malaysia’s lacklustre FDI rates, which have fallen faster than regional counterparts such as Singapore and China even while capital outflows dampened private domestic investment.

The World Foreign Investment Report (WIR) 2010 released by the United Nations showed that FDI in Malaysia plunged 81 per cent last year, trailing behind countries like the Philippines, Vietnam, Thailand, Indonesia and Singapore.

The report revealed that Malaysia suffered a large 81.1 per cent drop in FDIs compared to far healthier figures in Thailand (30.4 per cent), Vietnam (44.1 per cent) and Indonesia (44.7 per cent).

In May, Minister of International Trade and Industry Mustapa Mohamed announced that investments in the country for Q1 2010 amounted to RM5.2 billion.

FDIs made up RM3.2 billion of this total, with Singapore, Taiwan and Japan being the biggest contributors.

Mustapa said the investment amount was still relatively low against the total amount of RM32.6 billion in investments received last year.

Najib has been trying to lift Malaysia’s profile as a destination for foreign investment to help the country achieve an average GDP growth of at least 6 per cent per annum over the next five years.

However, his administration has insisted that the GDP growth target is still achievable despite warning that the economy may slow down in the second half of the year due to external factors.

Labels:

Economy

July 25, 2010

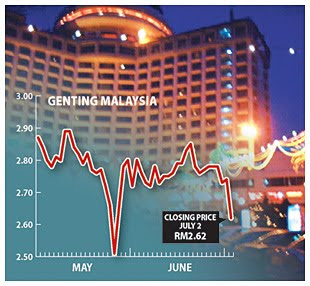

Genting NY still in running for racino deal

KUALA LUMPUR: Genting Malaysia Bhd subsidiary Genting New York LLC is still in the running for the bid to develop and operate a video lottery facility at New York City’s Aqueduct Racetrack, sources said.

Last Friday, New York Supreme Court Judge Barry Kramer ruled that the New York State Division of Lottery can continue to evaluate the final remaining contender, Genting New York, in the latest round of the bid for at least one more week.

The judge also said he would continue the hearing for the lawsuit against the state for rescinding its awarding of the lucrative racino contract to the winner of the previous bidding round on July 29. He is expected to make a decision on the case then.

Last week, Aqueduct Entertainment Group (AEG), the consortium that won the previous round only to have its gambling licence application denied, sued Lottery and several elected officials seeking a permanent halt to the new bidding process.

Instead, AEG wants to proceed with its plan to develop and operate the racino. Judge Kramer ordered a halt to the latest bidding process on July 14, only to lift the temporary restraining order two days later.

Genting New York and two other US-based parties had on June 30 confirmed that they had submitted a bid for the Aqueduct project.

The successful firm which gets the approval for the project will, among other things, develop a designated and dedicated area to house and operate a slot machine-style “racino” (a combination of racetrack and casino) with 4,500 video-lottery terminals, and food and retails outlets.

Meanwhile, real estate Crain’s New York.com website reported that a Lottery spokeswoman said Lottery would continue with the vetting process of Genting New York and still intended to announce its recommendation on Aug 3, unless it was ordered otherwise.

However, a US Supreme Court in the middle of this month halted any further developments to the proposed racino so that it could ensure whether a previous winner of the same project – AEG – had been wrongly rejected thus the hearing last Friday.

Labels:

Stocks

July 22, 2010

Genting presents Aqueduct plans

Genting NY spokesman Jay Walker goes over the group's plans for Aqueduct Race Track during a public hearing at the Ozone Park track. Photo by Howard Koplowitz

The only bidder vying for the video lottery terminal contract at Aqueduct Race Track informed the community of its plans during a public hearing at Aqueduct last week and said it would draw customers from John F. Kennedy International Airport, Citi Field and Manhattan if it is lucky enough to be selected by the state Lottery Division.

Jay Walker, spokesman for Genting NY — a subsidiary of the Malaysian-based conglomerate Genting Malaysia Berhad — said the company will turn Aqueduct into “a tourist magnet that can attract people from Manhattan, the Mets and JFK.”

Walker said about 45 million people pass through Kennedy every year and “hardly any of them stop off here,” referring to Aqueduct.

“These people who are sitting, watching TVs at JFK concourse, that is our job right there,” he said. “All we have to do is market to these people.”

Walker also said Citi Field, where about 3 million Mets fans attend games in Flushing each year, could be a good area to get Aqueduct customers either by using shuttles buses or trains.

Genting would also look to the 47 million people who visit the city every year. Aqueduct is accessible via the A train from Manhattan and Jamaica Station.

Walker said the plan is “three ways that a smart company can partner with the community to build a day-trip destination here.”

But City Councilman Eric Ulrich (R-Ozone Park) was skeptical that Genting’s reliance on the subway to attract customers was viable considering Metropolitan Transportation Authority service cuts, saying the A train is “bursting at the seams.”

Walker said Genting would try to persuade the MTA that if it added more trains to make Aqueduct more accessible to Aqueduct customers, the agency’s revenue would increase.

Amid a report from the Center for an Urban Future that suggested the Aqueduct site be used for something other than a racino, Community Board 10 Chairwoman Betty Braton asked the hearing’s attendees to raise their hands if they agreed with the study, but nobody did. [Does it look like the community is behind the Genting bid?]

Genting introduced its executives and the architectural firm it hired to design its plans to the community during the hearing.

Genting NY President Michael Speller said he has 35 years of gaming industry experience and was a former president of Foxwoods Casino in Connecticut.

“We will make sure that the impacts that will happen [during construction at Aqueduct] are minimized,” he said. “We want to create a destination area for a great day-trip, evening trip. It’s got to be more than slot machines ... and it has to be great entertainment.”

Speller said city residents who go to casinos usually flock to Connecticut or Atlantic City.

“It’s important that these customers choose Aqueduct over Connecticut or New Jersey,” he said.

Speller said if selected, Genting expects to spend $30 million a year on local goods and services, including advertising, food service and taxi drivers.

Brian Davis of JCJ Architecture, a firm partnering with Genting, said plans for Aqueduct include a three-story atrium with a digitized water show.

“This is not a slot parlor,” he said. “This is a casino that will rival any gaming experience.”

Also planned are a two-story food court, buffet, 100-seat signature restaurant with private rooms for parties and a Chinese restaurant.

Do you concur with this Genting plan? will it sustain revenue and profit or is it an American dream for Kok Thay?

Labels:

Stocks

July 21, 2010

Malaysia: How poor are we, really?

The government likes to boast that Malaysia has almost erased poverty. It is the one unchallenged success that is shouted out again and again to show how far we have come since Merdeka.

The government likes to boast that Malaysia has almost erased poverty. It is the one unchallenged success that is shouted out again and again to show how far we have come since Merdeka.The line is familiar: “In 1970, 49.7 per cent of households were living in poverty. Now it is only 3.8 per cent.” Or out of 6.2 million households, only 228,400 can be classified as poor.

These 228,400 are households that earn an average of RM800 a month and below.

Is RM800 a fair cut-off point? Because it effectively means that if a household of four earns RM900, RM1,000, or even RM1,500 a month, they cannot be considered poor.

If that is the case, then why are there more and more media reports of families complaining that they cannot make ends meet even when they earn RM2,000?

How did the government calculate and decide that RM800 is the poverty line?

Jayanath Appudurai, who writes extensively on poverty for the Centre for Policy Initiatives, believes that the government’s calculations are unrealistic.

Here, he argues that we need a new standard to measure poverty — one that more accurately represents the cost of food, clothing, rent and other basic necessities, and how much it takes for an average family of four to keep themselves afloat in today’s Malaysia.

Jayanath’s assessment is based on government data in its 10th Malaysia Plan (10MP) report released in June, and the New Economic Model (NEM) that was out in April.

Jayanath’s assessment is based on government data in its 10th Malaysia Plan (10MP) report released in June, and the New Economic Model (NEM) that was out in April.The Poverty Income Level (PLI) is defined as:

“An income that is necessary to buy a group of foods that would meet the nutritional needs of the members of a household. The income is also to meet other basic necessities such as clothing, rent, fuel and utilities, transport and communications, medical expenses, education and recreation.”

Plainly speaking, the PLI is how much money in a month a Malaysian household needs to meet these eight components.

Though the Government calculates different PLIs for Malaysia’s three regions, the total average PLI is RM800.

Though the Government calculates different PLIs for Malaysia’s three regions, the total average PLI is RM800.For this demonstration, Jayanath uses the Peninsula PLI of RM763.

A household living in the peninsula is considered poor only if its monthly income is below RM763.

“The government claims that it uses a World Bank standard to measure PLI. But they do not reveal the actual methodology of how they arrive at RM763,” says Jeyanath.

The World Bank standard, Jayanath says, recommends that medium-income countries should calculate PLI based on US$2 (RM6.20) per individual per day. Meaning one person would need US$2 per day in order to meet both food and non-food necessities.

If that figure were used for Malaysia, a theoretical household of 4.4 people would then need RM858 a month to not be declared poor.

The government considers a household as comprising an average of 4.4 members, says Jayanath. (Total number of households divided by total population = 4.4).

The government considers a household as comprising an average of 4.4 members, says Jayanath. (Total number of households divided by total population = 4.4).The PLI of RM763, therefore, is translated into a daily income of RM25.45 that a household needs to meet the eight components such as food, rent, clothing and fuel.

“Or, that if a member of a household earns RM5.80 a day, they cannot be considered poor. Since, according to the government, you are able to live on RM5.80 a day.

In other words Jayanath explains:

“RM5.80 is supposed to pay for three meals, transport costs, rent, recreation and the other components for ONE person in ONE day. Tell me, can a Malaysian in the Peninsula even buy three meals a day on RM5.80?

“In fact, I’d challenge our government ministers to try that,” said Jayanath.

Jayanath says countries such as Britain and Australia calculate PLIs based on the median income of its households. The median income is a country’s total income divided by half.

Jayanath says countries such as Britain and Australia calculate PLIs based on the median income of its households. The median income is a country’s total income divided by half.The PLI is two-thirds of the median income.

In Malaysia the median income is RM2,830. Using this method, the PLI would then be RM1,886.

In effect, this translates into RM14.20 per day for an individual to meet all their eight needs.

“Compared to RM5.80, is not RM14.20 a more realistic figure in terms of how much one needs per day in Malaysia?”

A former finance minister had once said, repeatedly, that if we were to revise how we measure poverty, our poverty rate would not be the vaunted 3.8 per cent. He is right, technically.

Jayanath’s calculations would put Malaysia’s poverty rate at somewhere between 31 to 32 per cent.

Jayanath’s calculations would put Malaysia’s poverty rate at somewhere between 31 to 32 per cent.“Our poverty level looks good on paper but woefully ignores reality. We are so obsessed with selling this story that we are a success.”

Statistics are supposed to accurately measure our economic environment, so that in this case, pin-point policies to deal with poverty can be crafted.

The government has begun scaling back subsidies so that it would only benefit those their meant for — the poor.

How is it supposed to do this if we cannot even accurately measure who the poor are?

How did the government calculate and decide that RM800 is the poverty line?

Jayanath Appudurai, who writes extensively on poverty for the Centre for Policy Initiatives, believes that the government’s calculations are unrealistic.

Here, he argues that we need a new standard to measure poverty — one that more accurately represents the cost of food, clothing, rent and other basic necessities, and how much it takes for an average family of four to keep themselves afloat in today’s Malaysia.

Jayanath’s assessment is based on government data in its 10th Malaysia Plan (10MP) report released in June, and the New Economic Model (NEM) that was out in April.

Jayanath’s assessment is based on government data in its 10th Malaysia Plan (10MP) report released in June, and the New Economic Model (NEM) that was out in April.The Poverty Income Level (PLI) is defined as:

“An income that is necessary to buy a group of foods that would meet the nutritional needs of the members of a household. The income is also to meet other basic necessities such as clothing, rent, fuel and utilities, transport and communications, medical expenses, education and recreation.”

Plainly speaking, the PLI is how much money in a month a Malaysian household needs to meet these eight components.

Though the Government calculates different PLIs for Malaysia’s three regions, the total average PLI is RM800.

Though the Government calculates different PLIs for Malaysia’s three regions, the total average PLI is RM800.For this demonstration, Jayanath uses the Peninsula PLI of RM763.

A household living in the peninsula is considered poor only if its monthly income is below RM763.

“The government claims that it uses a World Bank standard to measure PLI. But they do not reveal the actual methodology of how they arrive at RM763,” says Jeyanath.

The World Bank standard, Jayanath says, recommends that medium-income countries should calculate PLI based on US$2 (RM6.20) per individual per day. Meaning one person would need US$2 per day in order to meet both food and non-food necessities.

If that figure were used for Malaysia, a theoretical household of 4.4 people would then need RM858 a month to not be declared poor.

The government considers a household as comprising an average of 4.4 members, says Jayanath. (Total number of households divided by total population = 4.4).

The government considers a household as comprising an average of 4.4 members, says Jayanath. (Total number of households divided by total population = 4.4).The PLI of RM763, therefore, is translated into a daily income of RM25.45 that a household needs to meet the eight components such as food, rent, clothing and fuel.

“Or, that if a member of a household earns RM5.80 a day, they cannot be considered poor. Since, according to the government, you are able to live on RM5.80 a day.

In other words Jayanath explains:

“RM5.80 is supposed to pay for three meals, transport costs, rent, recreation and the other components for ONE person in ONE day. Tell me, can a Malaysian in the Peninsula even buy three meals a day on RM5.80?

“In fact, I’d challenge our government ministers to try that,” said Jayanath

Jayanath says countries such as Britain and Australia calculate PLIs based on the median income of its households. The median income is a country’s total income divided by half.

Jayanath says countries such as Britain and Australia calculate PLIs based on the median income of its households. The median income is a country’s total income divided by half.The PLI is two-thirds of the median income.

In Malaysia the median income is RM2,830. Using this method, the PLI would then be RM1,886.

In effect, this translates into RM14.20 per day for an individual to meet all their eight needs.

“Compared to RM5.80, is not RM14.20 a more realistic figure in terms of how much one needs per day in Malaysia?”

A former finance minister had once said, repeatedly, that if we were to revise how we measure poverty, our poverty rate would not be the vaunted 3.8 per cent. He is right, technically.

Jayanath’s calculations would put Malaysia’s poverty rate at somewhere between 31 to 32 per cent.

Jayanath’s calculations would put Malaysia’s poverty rate at somewhere between 31 to 32 per cent.“Our poverty level looks good on paper but woefully ignores reality. We are so obsessed with selling this story that we are a success.”

Statistics are supposed to accurately measure our economic environment, so that in this case, pin-point policies to deal with poverty can be crafted.

The government has begun scaling back subsidies so that it would only benefit those their meant for — the poor.

How is it supposed to do this if we cannot even accurately measure who the poor are?

Labels:

Perspectives

July 15, 2010

Survey: Boo-Hoo!Global Fund Managers Will Ignore Malaysia

What a blow-another real low blow!

How sad that Malaysia has been relegated to the second-least-favoured destination among global emerging market (GEM) fund managers.

How sad that Malaysia has been relegated to the second-least-favoured destination among global emerging market (GEM) fund managers.

This is a serious matter since it comes from a poll conducted by Bank of America Merrill Lynch Global Research which has just been released this week.

The July survey had Taiwan, Malaysia and Chile as the most underweight markets for GEM investors. They were also slightly underweight on China due to slower growth prospects.

In financial markets, the term underweight is used by analysts to advise investors to reduce their holdings.

The findings of the survey could potentially signify a setback for poor PM Najib's bid to make Malaysia into a more competitive destination for global portfolio investment.

The Najib administration has been trying to lift Malaysia’s profile as a destination for foreign investment to help the country achieve an average gross domestic product growth of at least six per cent per annum over the next five years so that it can become a high-income nation.

The country’s foreign direct investment rates have fallen faster than other regional players like Singapore and China, and at the same time, capital outflows have dampened private domestic investments. Net portfolio and direct investment outflows had reached US$61 billion (RM197 billion) in 2008 and 2009 according to official data.

Asia-Pacific fund managers that were surveyed, though slightly underweight on Malaysia, held a more favourable view of the country and were looking to cut back the most in Korea, India and Australia instead, while China, Indonesia and Taiwan were the most-favoured markets.

There was an increased pessimism among the fund managers overall on the economic outlook, with a net 12 per cent expecting weaker economic conditions over the next 12 months, as compared with a net 42 per cent expecting a stronger global economy in a survey two months ago.

The fund managers also expect China’s prospects to worsen, with a net 39 per cent expecting weaker growth, as compared with 60 per cent seeing stronger growth in January of this year.

Malaysia’s economy grew by an impressive 10.1 per cent in the first quarter of this year but the prime minister had on July 6 cautioned that growth in the second quarter could be slower due to deteriorating external circumstances.

The local stock market had been on a seven-day winning streak and neared a two-year peak before succumbing to profit-taking yesterday.

About 200 global fund managers with portfolios worth from US$250 million to over US$10 billion had participated in the Bank of America Merrill Lynch survey.

So ,are we wiping away our tears?

Don't Cry for me, Malaysia?

The July survey had Taiwan, Malaysia and Chile as the most underweight markets for GEM investors. They were also slightly underweight on China due to slower growth prospects.

In financial markets, the term underweight is used by analysts to advise investors to reduce their holdings.

The findings of the survey could potentially signify a setback for poor PM Najib's bid to make Malaysia into a more competitive destination for global portfolio investment.

The Najib administration has been trying to lift Malaysia’s profile as a destination for foreign investment to help the country achieve an average gross domestic product growth of at least six per cent per annum over the next five years so that it can become a high-income nation.

The country’s foreign direct investment rates have fallen faster than other regional players like Singapore and China, and at the same time, capital outflows have dampened private domestic investments. Net portfolio and direct investment outflows had reached US$61 billion (RM197 billion) in 2008 and 2009 according to official data.

Asia-Pacific fund managers that were surveyed, though slightly underweight on Malaysia, held a more favourable view of the country and were looking to cut back the most in Korea, India and Australia instead, while China, Indonesia and Taiwan were the most-favoured markets.

There was an increased pessimism among the fund managers overall on the economic outlook, with a net 12 per cent expecting weaker economic conditions over the next 12 months, as compared with a net 42 per cent expecting a stronger global economy in a survey two months ago.

The fund managers also expect China’s prospects to worsen, with a net 39 per cent expecting weaker growth, as compared with 60 per cent seeing stronger growth in January of this year.

Malaysia’s economy grew by an impressive 10.1 per cent in the first quarter of this year but the prime minister had on July 6 cautioned that growth in the second quarter could be slower due to deteriorating external circumstances.

The local stock market had been on a seven-day winning streak and neared a two-year peak before succumbing to profit-taking yesterday.

About 200 global fund managers with portfolios worth from US$250 million to over US$10 billion had participated in the Bank of America Merrill Lynch survey.

So ,are we wiping away our tears?

Don't Cry for me, Malaysia?

Labels:

Economy

Penthouse owner offers RM672m for Playboy

Hefner (left) laughs with Playboy's Playmate of the Year Hope Dworaczyk during a celebration in Las Vegas, Nevada May 15, 2010.

The owner of Penthouse magazine yesterday offered to buy rival Playboy Enterprises Inc for US$210 million (RM672 million), making a bid that was 13 per cent above the buyout proposal from Playboy’s iconic founder Hugh Hefner earlier this week.

To sweeten the deal, Penthouse publisher FriendFinder Networks said Hefner is welcome to retain editorial control of Playboy magazine and to continue to reside in the Playboy Mansion — a property valued at roughly US$40 million, including art, according RBC Capital Markets estimates.

Hefner “built a cultural icon and he is a cultural icon,” FriendFinder Chief Executive Marc Bell told Reuters in a telephone interview. “He is trying to protect his legacy. We would love nothing more than to help him achieve his goal, protect his legacy and really become a partner.”

A company synonymous with bunny ears and centrefolds, Playboy has been struggling to put its business back on course as circulation and advertising revenues decline with people flocking to the Internet for free pornography.

FriendFinder proposed to give Playboy shareholders US$6.25 a share, above the US$5.50 per share, or US$185 million, from Hefner and his partner Rizvi Traverse Management.

Hefner, 84, already owns around 70 per cent of Playboy’s Class A common stock and 28 per cent of its Class B stock. Shares of Playboy closed up a penny, or 0.2 per cent, at US$5.52 on the New York Stock Exchange yesterday.

Playboy said in a statement it received FriendFinder’s proposal and the board would give it “appropriate consideration.”

Several individual shareholders have filed suits against Playboy alleging that Hefner’s offer was not in the best interest of stakeholders. Hefner’s offer had represented a 40 per cent premium to Playboy’s market price at the time.

Marc Boyar of Boyar Asset Management, which owns a 1.3 per cent stake in Playboy, said that both Hefner and FriendFinder’s offers were inadequate. He predicted that if Playboy remained a publicly listed company, its shares would double in about two years.

“I think people actually are starting to believe this company is in the early stages of a really promising turnaround,” said David Bank an analyst with RBC Capital Markets.

With US$600, Hefner kickstarted a shift in cultural thinking about sex when he launched the first issue of Playboy with a partially nude photo of Marilyn Monroe in 1953.

“The word playboy became metaphoric for a very distinctive lifestyle,” said Robert Thompson, professor of popular culture at Syracuse University.

Hefner turned Playboy and its bunny head logo into a symbol for a lifestyle he embodied as bachelor extraordinaire, living in a mansion surrounded by wealth and beautiful women.

But after the 1970s, Playboy began to fade. Hefner was forced to let go of some trappings such as a private jet plane with a bedroom, a miniature disco and a kitchen, according to Steven Watts, author of “Mr Playboy: Hugh Hefner and the American Dream.”

Hefner, though, has managed to stay in the spotlight. “He’s kind of like Betty White in that regard, he never goes away,” Thompson said.

In an effort to get some of its lustre back, Playboy appointed Scott Flanders, the former CEO of Freedom Communications and the publisher of the Orange County Register, as its top executive last year. Previously, Christie Hefner, Hugh Hefner’s daughter, ran the company.

While Flanders has been at the helm he has cut costs, outsourced the magazine’s production except for its editorial content and struck licensing deals with clothing makers, casinos and clubs.

“There is still some value but for the most part it not necessarily a growing business,” said Rick Munarriz, a senior analyst at The Motley Fool.

With Flanders’ appointment, speculation mounted that Hugh Hefner was looking to exit the business he had controlled for more than 50 years as Playboy searched for a potential buyer.

Late last year, Playboy was in talks to sell itself to Iconix Brand Group Inc, a company that licenses clothing brands such as Joe Boxer, but no deal was reached. Iconix said in June it was no longer looking at a potential licensing deal with Playboy because it was “uncomfortable” with some of Playboy’s businesses.

FriendFinder’s Penthouse faces similar business challenges to Playboy.

“Penthouse is under the same pressures of trying to become viable in this digital age,” said Brad Adgate, senior vice president of research at Horizon Media. “I don’t know what they would do that would be anything substantially different.”

FriendFinder, which hired Imperial Capital LLC as its financial adviser, said it had contacted potential financiers and was confident it would have the funds available for the acquisition.

FriendFinder said its deal could value Playboy’s equity at more than US$210 million depending on the results of due diligence and updated financial data.

Labels:

Perspectives

Nomura Now upgrades GenM

Nomura Research says after recent sell down and downgrades, it believes that all the bad news has been priced in and expects earnings upgrades as the key catalyst going forward.

Nomura Research has upgraded its call on Genting Malaysia to a "buy" from neutral previously, backed by strong domestic operations and Genting UK to contribute positively in the long run.

The research house said after recent sell down and downgrades, it believes that all the bad news has been priced in.

"Fundamentally, we see earnings upgrades as the key catalyst going forward," it said, noting that the company looks appealing on a risk-reward basis.

GENM's proposed acquisitions of the UK and the US casinos will exhaust most of its cash, removing the overhang of concern on its plan for its huge cash reserves.

Besides upgrading the call to "buy", Nomura also increased its target price to RM3.70 from RM2.66 previously.

The research house said competition for GENM's mass market business is likely to be shortlived where its domestic operation should continue to generate strong cash flows.

"Consensus earnings upgrades post second quarter 2010 earnings, scheduled to be released in August would likely trigger a re-rating of the stock.

As I have said before, do not willy-nilly follow most of these yoyo fund manager predictions. Do your own homework if you intend to buy or sell GenM.

Nomura Research has upgraded its call on Genting Malaysia to a "buy" from neutral previously, backed by strong domestic operations and Genting UK to contribute positively in the long run.

The research house said after recent sell down and downgrades, it believes that all the bad news has been priced in.

"Fundamentally, we see earnings upgrades as the key catalyst going forward," it said, noting that the company looks appealing on a risk-reward basis.

GENM's proposed acquisitions of the UK and the US casinos will exhaust most of its cash, removing the overhang of concern on its plan for its huge cash reserves.

Besides upgrading the call to "buy", Nomura also increased its target price to RM3.70 from RM2.66 previously.

The research house said competition for GENM's mass market business is likely to be shortlived where its domestic operation should continue to generate strong cash flows.

"Consensus earnings upgrades post second quarter 2010 earnings, scheduled to be released in August would likely trigger a re-rating of the stock.

As I have said before, do not willy-nilly follow most of these yoyo fund manager predictions. Do your own homework if you intend to buy or sell GenM.

Labels:

Stocks

July 13, 2010

GentingM:The Racino Caper

The Malaysian firm that runs the largest casino in the world is in a one-horse race to become the operator of Aqueduct race track's slot machine casino near Kennedy Airport.

Until now, Genting Malaysia Berhad has had only a behind-the-scenes presence in U.S. gaming as an investor, including providing seed money for the Foxwoods casino in Connecticut.

But last week, the state Lottery Division disqualified two other bidders, making Genting the only contender left standing. If lottery officials and legislative leaders ultimately approve Genting's bid, the company will for the first time take on an upfront role in North America.

Earlier this year, state leaders had a deal with Aqueduct Entertainment Group - which boasted the politically connected Rev. Floyd Flake as one of its partners - but AEG was found to be unlicensable by lottery officials.

Details of what a Genting-run Aqueduct would look like began to emerge over the weekend when the company disclosed some plans for the antiquated site.

In addition to 4,500 slot machines, there would be a two-story, 450-seat food court, a 34,000-square-foot meeting site for corporate and community events, an entertainment center, a 2,200-car garage, shuttle buses to JFK, valet parking and an outdoor terrace that could accommodate 10,000.

And of course, a 75-foot waterfall.

"It's going to look like a first-class casino," Jay Walker, Genting's spokesman, said.

Genting will outline its plans in more detail Thursday night for Community Board10, which was stunned last week when lottery officials said the other two bidders, SL Green and Penn National Gaming, had been disqualified.

Those firms inserted too many protections for themselves into their proposals, officials said, including provisions that would shield them if Nassau County manages to get the Shinnecock tribe to build a rival casino at the Nassau Coliseum.

Genting has already generated some controversy in New York.

Last year, Joseph Bernstein, the former CEO of Empire Resorts, which runs Monticello's race track, complained to state racing authorities that he was pushed out of office by Genting, which has a $55 million investment in Empire.

Bernstein charged that Genting's representatives, Michael Brown and Colin Au, were trying to make a side deal with the St. Regis Mohawk tribe to sell the tribe some of Empire's land for a casino - a deal that Bernstein said would hurt Empire's investors.

He later withdrew his complaint after getting a $1.5 million severance package, but the state Racing and Wagering Board is continuing to investigate all the same, an agency spokesman said.

Genting is known for lending money to Native American tribes at a hefty interest rate of 30%; members of the Seneca Nation have complained that more profits from their casinos went to Malaysia than to upstate New York.

Labels:

Stocks

GenM: Now it is a Buy?

Genting Malaysia Bhd, the country’s sole casino operator, rose the most in three weeks in Kuala Lumpur trading after Morgan Stanley initiated coverage of the stock with an “overweight” call and RM3.05 share forecast.

The stock rose 1.1 per cent to RM2.69 at 9:05 a.m. local time, set for its biggest gain since June 18.

I think we should retire all these fund managers and hire someone we can truly trust- Paul, the Octopus!

Labels:

Stocks

July 09, 2010

Pig Trotters: Collagen,Chondrotin,Glucosamine

Yes, this is a rave in London. Get the real thing that gives give the required collagen, chondroitin and glucosamine.

Labels:

Perspectives

Malaysian Everest Conquerors: Recognition at Last

N. Mohanadas and M. Magendran made Malaysians proud when they reached the summit of Mount Everest on May 23, 1997. Thirteen years later, both stand here today bearing state honours that carry the honorific “Datuk”.

The Penang state government conferred both with the Darjah Setia Pangkuan Negeri (DSPN) at the Governor’s 72nd birthday ceremony here today.

When contacted, 48-year-old Mohanadas said an award after 13 years has given him the sense that the two were “remembered and valued”.

The avid mountaineer also said that when he was picked for the expedition, rewards and recognition were not a priority for him.

“When selected for the mission, there was an obligation to fulfil for my country and my community,” he said.

Both were part of the Telekom Malaysia Mount Everest Project 1997 that started out on March 1 that year, which braved unpredictable weather and freezing temperatures to conquer the 8,848m “Goddess Mother of the World”, as Everest is known in Tibetan.

“We did not do it for awards. We did it to inspire others and I think we have succeeded,” the father of three boys added.

Mohanadas, who is still an active climber, is leading a group from a corporate organisation on an expedition to climb the 4,095m Mount Kinabalu on Aug 31.

The Shell Malaysia employee said he keeps himself fit by running and participating in marathons.

Mohanadas explained that the Penang state government had also approached him and Magendran to discuss the possibility of exposing youths from Penang to the sport.

He said although they did not have a structured plan as yet, discussions have been held with Deputy Chief Minister Prof P. Ramasamy.

“Penang has world-class [athletes] like (Datuk) Nicole David and (Datuk) Lee Chong Wei. They want to produce more of these people but in different fields,” said Mohanadas, who is also the chairman of Malaysian Outward Bound Youth Association and vice president of Malaysian Mountaineering Organisation.

Labels:

Perspectives

What an Octopussy!

In a World Cup of droning vuvuzelas, dodgy balls and substandard favourites, nothing has fascinated the public as much as the octopus named Paul.

So far, the seemingly precognitive Paul has correctly predicted the results of all German matches during the tournament, even their losses to Serbia and Spain.

Tomorrow, according to his handlers, Paul will predict the winner of the 2010 Fifa World Cup. If he is not tired.

Residing in the Oberhausen Sea Life Aquarium in Germany, the two-year-old cephalopod “predicts” the results of matches by picking one of two clear boxes bearing the flags of the competing countries. The boxes are arranged according to Fifa’s arrangement of flags for each match, and filled with food like mussels or oysters.

Previously, he has correctly predicted five out of six results from Germany’s campaign in Euro 2008.

After predicting Germany’s exit at the hands of Spain in the semi-final, Paul has since received death threats from many Germans who wish to see him served on their dinner tables.

Some punters and booking agencies have made money from following his advice, while animal rights group People for the Ethical Treatment of Animals (Peta) is urging for his release from his “imprisonment”.

Paul might be the first octopus to have done so, but he is surely not the first animal to tell fortunes or read minds. In 1927, a horse in Virginia, US named Lady Wonder was claimed to possess psychic powers and extra-sensory perception (ESP), and communicated by pushing toy letter blocks.

For the price of a dollar, one could ask the horse three questions, and over 150,000 people had taken up the offer. The horse also supposedly predicted the result of a boxing match, discovered oil, and solved a missing person case.

Another horse in 1900 in Germany, Clever Hans, was shown as having the ability to solve arithmetical and intellectual problems. Having a multi-talented owner who was a mathematics teacher, amateur horse trainer and phrenologist bestowed Hans with various abilities such as telling time, differentiating musical tones and understanding German.

In the 1980s, a dog called Harass II was purported by its handler, John Prestons, to be psychic. Harass II could supposedly find cold trails and human scent — even months or years later. He could also track underwater and after hurricanes, using his psychic powers.

Historically, humans have relied on observing animals for divination since thousands of years ago. Alectryomancy, practised by Etruscans in ancient Italy 2,400 years ago, enables people to tell fortunes by seeing roosters pecking at scattered grains.

The ancient Romans practised augury, divination by studying the flight of birds: whether any noise was made, whether they flew alone, their directions, etc. These duties were held by a special order of priests whose role was interpreting the gods’ messages.

This divination by observation extends to various other animals such as cats (felidomancy), horse (hippomancy), fish (ichthyomancy), spider and snakes (ophiomancy).

In the cases of Lady Wonder, Clever Hans and Harass II, it has been proven that the animals were unconsciously or unintentionally cued by their owners. In fact, this observer effect has been called the “Clever Hans Effect” and has been used to debunk many “intelligent” or “talented” pets over the years.

As for Paul, it is still not proven if he reacts to his trainer Oliver Walenciak’s cues or the expectant German fans. Although he has predicted 11 out of 12 matches correctly so far, it is noted that Paul chose Germany nine times out of 12. Considering Germany was the favourites in those nine matches, Paul had consequently better odds to be correct.

Being a common octopus (Octopus vulgaris), it has also been suggested that Paul has a preference for flags with bright horizontal stripes like Germany and Spain, instead of England or Argentina, despite not being able to see in colour.

The species is naturally found in shallow tropical and semi-tropical seas around the world and can grow up to 25cm, with tentacles up to a metre.

Labels:

Perspectives

July 07, 2010

The Submarine Which Won't Dive again.........

This is really bad, don't you think so?

The first Malaysian submarine apparently cannot dive once more and is at the moment docked somewhere in a naval base in Sabah.

Labels:

Perspectives

July 06, 2010

Genting: Another Racino Bid Write-up

In a stunning move, the State Lottery has disqualified two of the three bidders for the ill-fated Aqueduct “racino” project.

SL Green and Penn National Gaming were rejected only seven days after submitting their applications in the latest round of bidding for the long-delayed project.

That leaves just Genting New York in the running.

Genting “appears to conform with all requirements of the bid submission process and will continue to be evaluated,” the Lottery said in a statement.

If Genting ultimately is not approved for the Aqueduct project, the bidding process will have to start again. A recommendation from Lottery is due to Gov. Paterson and legislative leaders by Aug. 3.

Lottery officials said Penn National and SL Green, which was partnering with Hard Rock International and Clairvest Group, did not conform with the set criteria. Both failed to submit signed copies of the mandatory bid requirements.

Instead, the two bidders offered “altered versions” containing numerous changes they wanted.

Once believed to be a front-runner, SL Green, for example, wanted their minimum $300 million upfront fee to be held in escrow until their conditions were met by the state.

The group also wanted the right to make ownership changes without the state’s consent, a cap

on any increase in local property taxes at 3%, and a complete exemption of state and local

sales taxes for the construction of the racino.

Penn National, meanwhile, wanted to be able to terminate its Aqueduct video lottery license

any time it decides the casino has not been profitable for four straight quarters.

The group also wanted a guarantee that no other gaming facility would open within 50 miles

of Aqeuduct, despite those who are eying Belmont in the future.

Most of the changes sought by both groups were raised with Lottery before the bids were due.

“It was made clear that non-conforming bids would be disqualified,” Lottery said.

It would do us good to look at the issues raised by the other two bidders. Caveat emptor!

From what transpired recently where GenM was made into the 'monkey and donkey' to take over red ink of Genting UK from Genting S, be very careful of this rogue parent company, minority shareholders!

They are capable of cannibalism!

Labels:

Stocks

The New York Racino: Surviving the Competition

I am really neutral on this.

The latest Bloomberg report tells us that Genting Malaysia Bhd, is the only surviving bidder for an electronic slot-machine parlor at New York City’s Aqueduct Racetrack after two US-based firms were disqualified, the New York Lottery announced.

One excluded proposal was submitted by a group led by SL Green Realty Corp, Manhattan’s biggest office landlord, in a bid with partners Hard Rock International and Toronto-based Clairvest Group. The other was from Wyomissing, Pennsylvania-based Penn National Gaming Inc, which operates 19 casinos and racetracks.

“The proposals did not conform with the requirements of the competition and, instead, attempted to negotiate for terms more favorable to the bidders,” Lottery Director Gordon Medenica said in a statement. Neither New York-based SL Green nor Penn National will be eligible for reconsideration even if Genting isn’t approved, he said.

The project, called a racino, would include more than 4,000 video slot machines plus a hotel and other facilities located at the racetrack for thoroughbred horses in the New York City borough of Queens. The developer of the project, which has been planned for nine years, would pay a minimum US$300 million up- front fee to the state, which would issue US$250 million of bonds to help finance the facility, according to budget documents.

Lottery Evaluation

The Lottery’s evaluation of Genting’s bid will continue, and it is not guaranteed the award, even though it is the only remaining bidder, said Jennifer Given, a state spokeswoman. The Lottery expects to announce its recommendation by Aug. 3, she said. The winner must also be approved by the governor, the president of the state Senate and the speaker of the Assembly.

The Lottery’s announcement listed 19 aspects of the SL Green proposal that were called “non-responsive” by the Lottery. The Penn National proposal was disqualified on eight counts.

Genting Malaysia, based in Kuala Lumpur, said July 1 it will buy the UK casino businesses of Genting Singapore Plc for £340 million to expand overseas. Both companies are controlled by Genting Bhd., which has holdings in hotels, palm oil plantations and cruise lines.

Spokesmen for SL Green and Penn National couldn’t be reached for comment.

The latest Bloomberg report tells us that Genting Malaysia Bhd, is the only surviving bidder for an electronic slot-machine parlor at New York City’s Aqueduct Racetrack after two US-based firms were disqualified, the New York Lottery announced.

One excluded proposal was submitted by a group led by SL Green Realty Corp, Manhattan’s biggest office landlord, in a bid with partners Hard Rock International and Toronto-based Clairvest Group. The other was from Wyomissing, Pennsylvania-based Penn National Gaming Inc, which operates 19 casinos and racetracks.

“The proposals did not conform with the requirements of the competition and, instead, attempted to negotiate for terms more favorable to the bidders,” Lottery Director Gordon Medenica said in a statement. Neither New York-based SL Green nor Penn National will be eligible for reconsideration even if Genting isn’t approved, he said.

The project, called a racino, would include more than 4,000 video slot machines plus a hotel and other facilities located at the racetrack for thoroughbred horses in the New York City borough of Queens. The developer of the project, which has been planned for nine years, would pay a minimum US$300 million up- front fee to the state, which would issue US$250 million of bonds to help finance the facility, according to budget documents.

Lottery Evaluation

The Lottery’s evaluation of Genting’s bid will continue, and it is not guaranteed the award, even though it is the only remaining bidder, said Jennifer Given, a state spokeswoman. The Lottery expects to announce its recommendation by Aug. 3, she said. The winner must also be approved by the governor, the president of the state Senate and the speaker of the Assembly.

The Lottery’s announcement listed 19 aspects of the SL Green proposal that were called “non-responsive” by the Lottery. The Penn National proposal was disqualified on eight counts.

Genting Malaysia, based in Kuala Lumpur, said July 1 it will buy the UK casino businesses of Genting Singapore Plc for £340 million to expand overseas. Both companies are controlled by Genting Bhd., which has holdings in hotels, palm oil plantations and cruise lines.

Spokesmen for SL Green and Penn National couldn’t be reached for comment.

Labels:

Stocks

New Low for Lohan

It was a new low for Linsay Lohan when she was sentenced to 90 days imprisonment today for violating her parole of not attending alcoholics rehabilitation classes.

From a meteoric rise, she is now in the dumps. Yet another fallen princess of the silver screen.

Labels:

Perspectives

Electrical Wonder!

So, it is mid-July now? Hmmmmm.....

And so it would seem.

And so it would seem.

The Electric Train Service (ETS) which will reduce travel time between Ipoh and Kuala Lumpur to just two hours from three hours previously, is expected to be fully operational by mid July 2010.

Keretapi Tanah Melayu Berhad (KTMB) president Dr Aminuddin Adnan however, did not reveal the exact date of the launch of ETS.

“We are targeting professional groups and businessmen, besides the regular users of public transport, to use the service.

“With a speed of 140km/h, ETS will definitely reduce travel time, and the service of stewards and stewardesses will also provide comfort to passengers.

“In future, we will also provide wi-fi facilities in the train and we are in the midst of getting the right service provider,” he told Bernama in an interview here yesterday.

Eventually, he said, the ETS would also be expanded to Seremban.

Aminuddin said there were five ETS trains which would provide eight return trips for the Kuala Lumpur-Ipoh route daily, with the first train leaving at 5am and the last, 11pm.

On the fare, he said, KTMB was still waiting for approval from the transport ministry, adding that it was expected to be between RM30 and RM35 per trip.

Dr Aminuddin said KTMB had prepared an organised maintenance system for the ETS to ensure that it would not face similar problems as its existing train services.

“It is easier to maintain the electrical system with an organised maintenance plan. We hope to be able to provide an efficient and hassle-free train service, as compared to the commuter and inter-city train services,” he said.

He said each ETS train was also equipped with close-circuit television cameras to monitor the safety of the passengers, besides having the capacity of 350 passengers per trip.

Keretapi Tanah Melayu Berhad (KTMB) president Dr Aminuddin Adnan however, did not reveal the exact date of the launch of ETS.

“We are targeting professional groups and businessmen, besides the regular users of public transport, to use the service.

“With a speed of 140km/h, ETS will definitely reduce travel time, and the service of stewards and stewardesses will also provide comfort to passengers.

“In future, we will also provide wi-fi facilities in the train and we are in the midst of getting the right service provider,” he told Bernama in an interview here yesterday.

Eventually, he said, the ETS would also be expanded to Seremban.

Aminuddin said there were five ETS trains which would provide eight return trips for the Kuala Lumpur-Ipoh route daily, with the first train leaving at 5am and the last, 11pm.

On the fare, he said, KTMB was still waiting for approval from the transport ministry, adding that it was expected to be between RM30 and RM35 per trip.

Dr Aminuddin said KTMB had prepared an organised maintenance system for the ETS to ensure that it would not face similar problems as its existing train services.

“It is easier to maintain the electrical system with an organised maintenance plan. We hope to be able to provide an efficient and hassle-free train service, as compared to the commuter and inter-city train services,” he said.

He said each ETS train was also equipped with close-circuit television cameras to monitor the safety of the passengers, besides having the capacity of 350 passengers per trip.

Labels:

Perspectives

July 05, 2010

Watch The Camera!

Think you can get away with doing silly things?

Not today-with camera technology.

Here, a World Cup player get caught in 'his action!"

And here we see Diego Maradona, the Argentinian coach, 'fiddling ,diddling and dribbling" too.

Not today-with camera technology.

Here, a World Cup player get caught in 'his action!"

And here we see Diego Maradona, the Argentinian coach, 'fiddling ,diddling and dribbling" too.

Labels:

Perspectives

BNM's Last Rate Hike?

Come 8th July, we will know whether Bank Negara [BNM] will hike rates again once more or call for a momentary halt.

A Reuters report postulates that BNM may raise rates for the third time in five months after strong economic growth in the first half, but it could be a close call, with many analysts believing it will keep rates on hold due to fears of a global slowdown.

Nine out of sixteen analysts polled by Reuters expect a rate hike of 25 basis points to 2.75 per cent at a policy review on Thursday, while the remaining seven expect a pause.

Most of the economists who expect a hike in two days time do not see any more tightening for the rest of the year.

Of those who see no changes in rates this week, two said the central bank was already finished for the year, while three predicted it would bump up rates in September.

Malaysia last month raised its full-year economic growth forecast to 6 per cent from 4.5 to 5.5 per cent after gross domestic product (GDP) expanded by 10.1 per cent in the first quarter from a year earlier, its fastest pace in 10 years.

Export growth in April and May, however, have moderated compared to first quarter numbers and this may impact second-quarter economic growth. The central bank has said that domestic factors would drive policy considerations.

Uncertainties over the euro zone recovery and fears the US economy may be losing steam may also influence Bank Negara’s decision, with some economists saying that weak US economic data recently has lessened the chance of a domestic rate rise.

Late last month, Malaysia’s central bank governor said inflation was not a concern.

JULY HIKE, LAST OF THE YEAR?

After two, 25 bps rate hikes in March and May, Bank Negara will decide if it should further nudge rates to a more “normal” setting.

Economists consider that 2.75 per cent would be the normal rate for Bank Negara, while remaining accommodative to further growth, giving policymakers the opportunity to pause for the rest of the year to review the impact of the earlier tightening.

It cut rates by a total of 150 bps during the global financial crisis, from 3.5 to 2 per cent.

Domestic demand may remain firm as imports of consumption goods have been strong. In contrast, export growth has moderated, but some easing had been expected going into the second half.

Bank Negara has also downplayed any fallout from the euro zone debt crisis, although investors will watch its references to the global economic situation for clues on whether rate rises have ended for now, or if they will continue.

Probability: More likely.

Market impact: Both the ringgit and bond markets stand to gain from another rate hike as foreign investors would continue buying into government bonds, betting on more ringgit gains.

In June alone, 5-year government bond yields dropped 7 basis points while the ringgit appreciated by 1.2 per cent. The ringgit has gained more than 6 per cent year-to-date, making it the best performing Asian currency.

RATE PAUSE IN JULY, BUT TO CONTINUE LATER?

Growing uncertainty about the global economic recovery may lead to more moderate economic growth, prompting the central bank to pause its tightening campaign at the current 2.5 per cent before hiking rates once more in the fourth quarter.

Bond and forex traders say the sharply divided outlook for Thursday’s decision is due to the markets’ inability to gauge what the central bank considers to be an acceptable level.

The Official Policy Rate (OPR) has a relatively short history, making it difficult to determine what is considered a normal level. It was only introduced in 2004, with an initial setting of 2.7 per cent.

Three-month KLIBOR was quoted at 2.73 per cent today. In the forward starting swaps space, the 3-month rates swap on a contract starting after 3 months was quoted at 2.80 per cent.

This implies the market is pricing in just 7 bps of rate tightening by October. The KLIBOR in recent weeks has increased 6 bps since the May rate hike, compared to a 37 bps gain before the May rate hike, implying that there is less anticipation for a hike on Thursday.

Probability: Less likely

Market impact: A pause would not be a big cause for concern as foreign investors are still buying ringgit and government bonds as Asian currencies track yuan gains after China abandoned its two-year currency peg to the dollar.

Labels:

Perspectives

Genting: Load of Excuses for Another Daylight Robbery?

Genting Malaysia Bhd yesterday replied to Bursa Malaysia queries on the proposed acquisition of the casino businesses in Britain from sister company Genting Singapore plc for £340mil (RM1.66bil).

Genting Malaysia said that as at June 30, the total outstanding advances owed by the acquiree group (Britain casino business) to Genting Singapore plc was about £336,457.

Such outstanding advances owed by the acquiree group would be settled and/or waived prior to the completion of the proposed acquisition, it said.

It also said JPMorgan Securities (Malaysia) Sdn Bhd had based its valuation of the equity value of the acquiree group on a variety of intrinsic and public-market based methodologies, which included conducting a discounted cashflow valuation and an analysis on trading comparables.

The valuation of equity value was between £310mil and £370mil.

In arriving at the said valuation, JP Morgan had also, among others, reviewed certain publicly available business and financial information concerning the acquiree group and the industries in which they operate.

Bursa has asked Genting Malaysia to furnish it with the total amount of outstanding advances owed by the acquiree companies to Genting Singapore as at the latest date.

It also wanted to be informed of the salient features of the valuation of the equity value of the acquiree group as conducted by JPMorgan Securities (Malaysia) .

The plan, a third-party transaction, has drawn its fair share of criticism from analysts who said the investment was pricey for a risky market, provided little growth catalyst and may require more capital injection in the future

So are you on the jury for this value-bashing exercise of GenM by cannibalistic Genting Berhad?

Labels:

Stocks

July 04, 2010

Wilmar Sugar plans in Papaua New Guinea

Wilmar International Ltd said it plans to develop sugar plantation and sugar mill in Papua with an estimated investment cost of around US$2 billion, a company official said at the weekend.

M.P. Tumanggor, commissioner of PT Wilmar Nabati, a subdiaary of Wilmar International, was quoted by kontan.co.id on Saturday, said the company will conduct a feasibility study for investing in sugar plantation in Papua within the next six months.

"We don’t know for certain yet when the plan could be realized as the infrastructure in Papua is not sufficient," he said, noting the high transportation and distribution costs would make sugar price to be expensive and less competitive.

Tumanggor said Wilmar's management had been in talks with M.S. Hidayat, Industry Minister, as the company is proposing to get incentives for building roads and ports.

The cost to develop infrastructure alone in Papua could reach Rp2 trillion, he said.

Wilmar International operates in four business segments: merchandising and processing, consumer products, plantation and palm oil mills, and others.

The other segment includes the business of manufacturing and distribution of fertiliser products and ship-catering services.

The company sells 40 percent of its crude palm oil to its customers in Europe, China and India.

Labels:

Stocks

Wilmar: Coup d' Grace

Yes, play on a level playing field such as that of the world Cup in South Africa where even giants like Brazil and Argentina can fall by the wayside.

Robert Kuok sold off his Malaysian sugar interest entirely. He did not want the nefarious 'Arab and Camel' strategy model to be used to boot him out unceremoniously out of his sugar monopoly. He knows about non-transparent rules, political pressure from the top and changing of goal-posts.

Robert Kuok sold off his Malaysian sugar interest entirely. He did not want the nefarious 'Arab and Camel' strategy model to be used to boot him out unceremoniously out of his sugar monopoly. He knows about non-transparent rules, political pressure from the top and changing of goal-posts.

When the Malaysian authorities created a sugar duopoly, cutting off his sugar monopoly, Robert knew his days were numbered. So, he sold out the Malaysian sugar business, lock, stock and barrel. Great move, Bob Kuok!

Now he has brought into the Australian sugar business. Superb move.

Let us read the report from Reuters.

" SINGAPORE, July 5,2010 — Singapore’s Wilmar International Ltd on Monday struck a surprise deal to buy Australian conglomerate CSR Ltd’s sugar business for A$1.75 billion (RM4.75 billion), trumping China’s Bright Food Group.

Shares in CSR, the world’s fifth-largest sugar-refiner, climbed more than 4 per cent after CSR announced it had agreed to sell the sugar arm to Wilmar, the world’s largest listed palm oil producer.

Bright Food, which has been chasing CSR since January, was not expected to come back with a higher offer, according to two sources close to the transaction. CSR had also held talks with several other interested bidders, they said.

“The deal is done, there is no real opportunity for them (Bright Food) to come back to raise their offer,” one of the sources said.

Wilmar’s purchase price was A$1.347 billion for equity and A$403 million for debt, 6 per cent higher than a conditional A$1.65 billion offer Bright Food made to CSR’s board late last week.

The deal was a coup for conglomerate CSR which has spent more than a year working on plans to either spin-off the sugar business into a separately listed company, or sell the asset.

Until the Wilmar bid, the market was unaware of any other bidders looking at the asset.

WILMAR’S SUGAR PUSH

Wilmar said the deal was part of plans to expand its sugar business.

“This is positive news as it’ll help jump start their strategy to expand in the sugar business and (represents) the next growth driver for Wilmar,” said DBS Vickers analyst Ben Santoso.

He added that acquiring CSR’s sugar business would also give Wilmar expertise in cane-related research and development.

Now he has brought into the Australian sugar business. Superb move.

Let us read the report from Reuters.

" SINGAPORE, July 5,2010 — Singapore’s Wilmar International Ltd on Monday struck a surprise deal to buy Australian conglomerate CSR Ltd’s sugar business for A$1.75 billion (RM4.75 billion), trumping China’s Bright Food Group.

Shares in CSR, the world’s fifth-largest sugar-refiner, climbed more than 4 per cent after CSR announced it had agreed to sell the sugar arm to Wilmar, the world’s largest listed palm oil producer.

Bright Food, which has been chasing CSR since January, was not expected to come back with a higher offer, according to two sources close to the transaction. CSR had also held talks with several other interested bidders, they said.

“The deal is done, there is no real opportunity for them (Bright Food) to come back to raise their offer,” one of the sources said.

Wilmar’s purchase price was A$1.347 billion for equity and A$403 million for debt, 6 per cent higher than a conditional A$1.65 billion offer Bright Food made to CSR’s board late last week.

The deal was a coup for conglomerate CSR which has spent more than a year working on plans to either spin-off the sugar business into a separately listed company, or sell the asset.

Until the Wilmar bid, the market was unaware of any other bidders looking at the asset.

WILMAR’S SUGAR PUSH

Wilmar said the deal was part of plans to expand its sugar business.

“This is positive news as it’ll help jump start their strategy to expand in the sugar business and (represents) the next growth driver for Wilmar,” said DBS Vickers analyst Ben Santoso.

He added that acquiring CSR’s sugar business would also give Wilmar expertise in cane-related research and development.

Santoso expected the new business to see synergies from capitalising on Wilmar’s extensive distribution to China and Asia.

In Singapore, Wilmar’s shares rose as much as 2.3 per cent.

CIMB analyst Ivy Ng said the deal was positive in the medium term because it gave Wilmar knowledge to expand to other parts of Asia.

“But in the short term, based on what they have so far it does not appear the acquisition will significantly increase their earnings,” said Ng.

“In the longer term, it would be good if they can replicate the business in other parts of Asia like China, India and Indonesia, but you won’t see that tomorrow.”

CSR said the deal was expected to be completed by the last quarter of 2010, and is conditional on approval by Australia’s Foreign Investment Review Board (FIRB).

In May, FIRB delayed its decision on the Bright Food bid for up to 90 days, which raised concerns the bid may be blocked.

CSR said net proceeds from the deal would be about A$1.6 billion, and it would consider a range of options for the funds.

Great news for Wilmar and PPB shareholders after the Indonesian supposed fiasco.

Labels:

Stocks

July 02, 2010

GenM Minority Holders: Do not Chicken Out!

You will be given your chance to fight big business come the next GenM EGM to reject or endorse the UK casino buy-out from GenS soon. Do not squander this one-in-a -billion chance!

Tell Kok Thay and his comatose BOD that enough is enough! Reject the deal! Save your coffer!

Let us read this report from the Malaysian Business Times.

"Minority shareholders may stymie Genting Malaysia Bhd's plan to buy Genting Singapore plc's casino business in the UK for £340 million (RM1.66 billion), analysts said yesterday.

This is the second largest related party transaction (RPT) involving the Genting group in a decade, following subscription of US$442 million (RM1.42 billion) Star Cruises shares, the 10 per cent purchase of Walker Digital Gaming for US$69 million (RM222 million) and the acquisition of Wisma Genting and Segambut property for RM284.1 million.

Genting Singapore is the biggest gaming operator in the UK with 44 venues under the Circus, Maxims and Mint brands.

"The purchase is a bit pricey, and delinquent shareholders are bound to raise the matter at the forthcoming EGM (extraordinary general meeting)," Affin Securities gaming analyst Chong Len Len told Business Times.

Genting, the country's sole casino operator, told the stock exchange on Thursday it will soon hold a special meeting to seek shareholders' support for the plan.

Since it is an RPT for Genting, Kien Huat Realty Sdn Bhd and Parkview Management Sdn Bhd, which collectively own 48.67 per cent of Genting, will not be able to vote at the meeting.

Likewise, Genting's chairman Tan Sri Lim Kok Thay, who is also the executive chairman and shareholder of Genting Singapore, will not be able to vote.

A slew of foreign funds such as Vanguard Emerging Markets Stock Index Fund, the Government of Singapore Investment Corp and Comgest Growth Emerging Markets own small chunks of Genting.

News of the planned purchase brought downgrades from research firms such as HwangDBS Vickers, OSK Research and Deutsche Bank. This took its toll on Genting shares yesterday.

The stock fell 12 sen to RM2.62 sen a share on heavy volume, just 11 sen higher than its lowest closing price in 52 trading weeks.

Elsewhere, Samuel Yin Shao Yang, a senior associate at ECM Libra, described the deal as value-destroying without accreting earnings.

"The fact that more than a quarter of Genting's net cash will be spent on an RPT, which is barely earnings accretive, does not sit easy with us," Yin wrote in the report. He recommended that investors sell the stock.

He reasoned that the Genting Group's rationale that only Genting Malaysia within the group has the financial muscle does not hold water.

"We beg to differ because as at December 31 2009, Genting Singapore's cash balance stood at S$2.8 billion (RM6.4 billion) and its net gearing was comfortable at 24 per cent," wrote Yin in the report.

He estimates that if Genting did not buy the casino assets from its sister company, the Malaysian outlet will have a cash war chest of RM6 billion by the year-end."

So say your piece at the EGM or forever hold your peace and suck on your thumbs!

Tell Kok Thay and his comatose BOD that enough is enough! Reject the deal! Save your coffer!

Let us read this report from the Malaysian Business Times.

"Minority shareholders may stymie Genting Malaysia Bhd's plan to buy Genting Singapore plc's casino business in the UK for £340 million (RM1.66 billion), analysts said yesterday.

This is the second largest related party transaction (RPT) involving the Genting group in a decade, following subscription of US$442 million (RM1.42 billion) Star Cruises shares, the 10 per cent purchase of Walker Digital Gaming for US$69 million (RM222 million) and the acquisition of Wisma Genting and Segambut property for RM284.1 million.

Genting Singapore is the biggest gaming operator in the UK with 44 venues under the Circus, Maxims and Mint brands.

"The purchase is a bit pricey, and delinquent shareholders are bound to raise the matter at the forthcoming EGM (extraordinary general meeting)," Affin Securities gaming analyst Chong Len Len told Business Times.

Genting, the country's sole casino operator, told the stock exchange on Thursday it will soon hold a special meeting to seek shareholders' support for the plan.

Since it is an RPT for Genting, Kien Huat Realty Sdn Bhd and Parkview Management Sdn Bhd, which collectively own 48.67 per cent of Genting, will not be able to vote at the meeting.

Likewise, Genting's chairman Tan Sri Lim Kok Thay, who is also the executive chairman and shareholder of Genting Singapore, will not be able to vote.

A slew of foreign funds such as Vanguard Emerging Markets Stock Index Fund, the Government of Singapore Investment Corp and Comgest Growth Emerging Markets own small chunks of Genting.