Day in and day out, when the stock market is in an upward direction, we have predictors, forecasters and oraclers telling us their supposedly hindsight 20-20 vision of what target prices a stock should be.

They could be fundamentalists or they could be those chaps operating from waves,candles and charts.

All the same, the have their share of predictions. Could they be believed?

Let us look at some of the stocks they are looking at today and what are their forecasted price in days to come. We must tell ourselves that they are all giving us their forecasts with the grand assumption that the global economic trends remain intact.

Let us look at three investment banks and their forecasts. The banks are Hwang-DBS Vickers,RHB Research and Am Research.

Let us look how they perceived one of South-east Asia's bluest of the blue shares-Sime Darby.

This stock is trading 25 sen up today at RM9.96.

Hwang opines that it will likely go up to RM11.25; RHB Research, being less optimistic, gives it a RM10.55 while Am Research gives it a 5 sen better at RM10.60. If a majority count is made, then Sime should move up to RM10-55-RM10.60. This will be a fair price projection.

Two investment houses recommend Sunway Holdings.

This stock is currently trading at RM2.62. Hwang believes that it can move up to RM3.30 while RHB cautiously reckon it can reach RM3.15.

One other stock is Digi. One investment house(I cannot recall-it could have been CIMB) said it will move up to RM4.40, It is currently settling down at RM4.06. A push of 34 sen and it will have arrived.

Meanwhile, do not expect all these shares to go up like an arrow.

There will be fits and starts, digestion issues, warts and all.

So, be patient!

February 29, 2012

Shifting Fortunes

Enrich thy neighbour,beggar thy neighbour.

As they say,English is contextual. It depends on the words and the situation that it is applied; to get at its real meaning.

So, in this case, it is clear that the meaning does not exist in a vacuum and not amongst neighbours proferring the same wares.

Reduction of taxes on edible oil by Indonesia is going to upset Malaysia for sure.

Unless Malaysia does the same thing to bring down taxes to an equivalent level, expect lower export yield as even Malaysian refineries may move to neighbouring Indonesia to tap on higher margins.

Will Malaysia put at risk a US20 billion industry?

Remember that foreign investors and smaller palm oil refiners process 60 per cent of the country’s output.US agribusiness Cargill and Japan’s Nisshin Olio operate refineries in Malaysia where the margins have come under severe pressure in recent months.

Malaysia definitely cannot afford to lose the investment already made by non-integrated refineries.The consequence could be catastrophic especially for the smallholders and private millers which are depending on them now to off-load their fresh fruit bunches and crude palm oil.

Currently, Indonesia is offering discounts on processed palm oil to markets in India and Pakistan as they enjoy a price advantage of US$100 per tonne because of lower export taxes.

Malaysia is undoubtedly worried about the 25 new refineries with a combined capacity of 9.6 million tonnes.coming on steam.

Independent Singaporean refiner Mewah, which owns some of the biggest factories in Malaysia, has already said it would delay ongoing plans for a new processor in Malaysia’s Sabah state to focus on building one in Indonesia.

Other existing players may follow Mewah so long as the government keeps an annual tax-free crude palm oil (CPO) export quota of 3 million tonnes, which tightens supply, raises feedstock costs and reduces factory use rates.

Malaysia taxes crude palm oil exports to protect its refining sector where capacity stands at nearly 24 million tonnes but imposes the quota to help firms like Sime Darby and IOI Corp feed their overseas refineries.

The duty free export quota will reduce the average refining capacity utilisation this year to about 68 per cent.

The impact will be more pronounced with the quota estimated to mop up about 15 per cent of Malaysia’s projected crude palm oil output this year of over 19 million tonnes.

Apparently,for some refineries with a refining capacity utilisation rate of less than 60 per cent, it would be difficult to sustain their operations.

The bigger blow for these standalone refiners will come from Indonesia where greater refining capacity use and lower export taxes will see less crude palm oil shipped to Malaysia.

In 2011,Malaysia imported a record 1.3 million tonnes of crude palm oil from Indonesia to keep its refineries running but this year, it could be an entirely different story. as limited imports could be costly and further depress margins.

On a sweeter note, big Malaysian palm oil firms with a huge plantation bank and refineries like Sime, IOI, KL Kepong and United Plantations will still survive,

This, however does not preclude them from investing in Indonesia because they have plantations there. Some have already joint-ventures in Indonesia in the downstream industry.

So, tax people at the Ministry of Finance, what next?

Labels:

Economy

February 28, 2012

Tanya Roberts-Such an Adorable Angel!

A common name such as Julie Rogers may not sound very appropriate for the last Angel for the 'Charlie's Angels' series but there you have it.

None other than Bond girl and Sheena of the Jungle took on this role as the final Angel to grace the small screen before the series faded into oblivion. She is none other than that flaming beauty called Tanya Roberts.

A cross between a dazzling Farrah and the delightfully charming Jaclyn Smith, Tanya Roberts held herself well.

Watch her is these serialised montages.

None other than Bond girl and Sheena of the Jungle took on this role as the final Angel to grace the small screen before the series faded into oblivion. She is none other than that flaming beauty called Tanya Roberts.

A cross between a dazzling Farrah and the delightfully charming Jaclyn Smith, Tanya Roberts held herself well.

Watch her is these serialised montages.

Labels:

Videos

Wow! What a Hack!

Shelley Hack is another Angel that many has forgotten.

She came into the series as Tiffany Welles after Kate Jackson left 'Charlie's Angels'.

Obviously, the most well remembered faces were that of the original trio-Farrah Fawcett as Jill Monroe,Kate Jackson as Sabrina Duncan and Jaclyn Smith as Kelly Garrett.

Then Cheryl Ladd joined the cast as Kris Munroe.

Here, watch, Shelley Hack is a video presentation as Tiffany Welles.

Enjoy!

She came into the series as Tiffany Welles after Kate Jackson left 'Charlie's Angels'.

Obviously, the most well remembered faces were that of the original trio-Farrah Fawcett as Jill Monroe,Kate Jackson as Sabrina Duncan and Jaclyn Smith as Kelly Garrett.

Then Cheryl Ladd joined the cast as Kris Munroe.

Here, watch, Shelley Hack is a video presentation as Tiffany Welles.

Enjoy!

Labels:

Videos

2 Nights at Berjaya Times Square Hotel

We were privileged to get a complimentary 2N3D stay at the beautiful Berjaya Times Square Hotel (BTSH).

Located right smack in town along Imbi Road with easy access to the famed Bukit Bintang Walk, BTSH was well positioned and we could easily get to Hutong at Lot 10 to savour all those generation-old hawker culinary delights.

For those who are more technologically attuned, they can go to the exciting Low Yat Plaza to shop for computers, GPS and other gadgets.

As midnight drew near, the lights adorning the Petronas Twin Towers switched off for the night as club crawlers started making their way home. Traffic trickled to single digits along the main thoroughfares after three in the morning.

Breakfast at the Big Apple was also delightfully pleasant to whet our appetite. The spread was quite good and is a fusion between the East and the West.

As for the room, we had a superior studio with two bedrooms and an adjoining kitchenite.

We had quite a good stay at the hotel.

Located right smack in town along Imbi Road with easy access to the famed Bukit Bintang Walk, BTSH was well positioned and we could easily get to Hutong at Lot 10 to savour all those generation-old hawker culinary delights.

For those who are more technologically attuned, they can go to the exciting Low Yat Plaza to shop for computers, GPS and other gadgets.

As midnight drew near, the lights adorning the Petronas Twin Towers switched off for the night as club crawlers started making their way home. Traffic trickled to single digits along the main thoroughfares after three in the morning.

Breakfast at the Big Apple was also delightfully pleasant to whet our appetite. The spread was quite good and is a fusion between the East and the West.

As for the room, we had a superior studio with two bedrooms and an adjoining kitchenite.

We had quite a good stay at the hotel.

Labels:

Holidays

YTL-Something's Brewing

After a long hibernation not unlike the seasonal preoccupation of the polar bear,YTL Corporation has stirred into some volume action.

I was away for the last two days and have not been keeping up with the Bursa action when I was told that YTL has cross into the RM1.50 price territory.

When an acquaintance told me about it, I was nonplussed as my average price was RM1.55 and that development was not really comforting.

This morning, it spurted passed the RM1.60 price on huge volume with some deals done in 100,000 tranches.

What is brewing in YTL as it is neither GAB or Carlsberg? And certainly not from heavy smoking in BAT?

What is Francis up to this time?

After taking YTL Cement off the board and compelling every shareholder possible to convert to YTL shares, he will be using his legal avenues to wrestle away those stubborn YTL Cement shareholders who refuse to part with their YTL Cement shares.

YTL Corp Bhd is a good share.

For its second quarter of its current fiscal year ended Dec 31, 2011, it posted a 44.6% year-on-year jump in net profit to RM237.4mil as compared with RM164.2mil a year earlier. YTL Corp and its listed arms' financial year ends on June 30, 2012.

For the quarter under review, the well-diversified group's revenue increased 18.4% year-on-year to RM5.3bil.

Francis informed the Group continued to perform well due mainly to the “ongoing resilience of our multi-utility businesses in Malaysia, Britain and Singapore”.

“Our cement and multi-utility operations, which are the group's major contributors, continue to register sound performance,” he added.

For the six months ended Dec 31, 2011, YTL Corp recorded a 10.4% year-on-year jump in net profit to RM489.2mil while revenue increased 10.8% to RM9.87bil.

Meanwhile, for the first half of FY12, YTL Power International Bhd's net profit grew 5.2% year-on-year to RM560mil while revenue rose 9.4% to RM7.7bil, due mainly to better performance of its merchant multi-utility businesses.

However, the division's YES mobile broadband operations registered a loss due mainly to the upfront implementation costs to build the 4G network for scale in order to cover the peninsula.

YTL Cement Bhd saw its net profit for the first half of FY12 grow by 8.8% year-on-year to RM167.9mil while revenue increased 12.2% to RM1.15bil due mainly to higher demand for cement in the construction industry and contributions from offshore subsidiaries.

On YTL Power, analysts said the company's results for the first half of FY12 were within expectations.

According to CIMB Research,YTL Power has a cash horde aimed for suitable mergers and acquisitions it can find.

“We believe YTL Power would eventually win the national 1Bestarinet smart school project. The project is worth RM300mil per annum over 10 years,” said CIMB Research. This is most interesting, don't you think? A certain little bird is up to no good?

Meanwhile, HwangDBS Vickers Research pointed out that YTL Power's dividend per share was lower quarter-on-quarter.

The research house said this was possibly because the company wanted to retain cash to fund increasing capital expenditure for YES, and potential investments in new power plants in Malaysia and overseas regulated assets.

YTL Power had declared a 1.875% or 0.9375 sen per share second interim dividend for FY12.

So, what do you think is brewing at YTL.

There will be no need for another share split. After the share exchange with YTL Cement shareholders, there is definitely a certain glut of YTL shares in the market.

Even the buying for Treasury shares is fast approaching the 10% legal limit.

So what can one expect from this sudden flurry of buying apart from possible Treasury buys?

Share redistribution in specie to loyal shareholders? Very likely.

At the close, YTL Corp became the most traded counter rising a spectacular 17 sen to RM1.75 on a volume of almost 12 million shares.

I think besides the Treasury buy-ins, other parties both speculators and institutions from at home and abroad could have jumped onto the counter on some expectations of positive corporate development.

Who knows?

Labels:

Stocks

The Wholesome Angel

If there is anyone of 'Charlie's Angels' that can be considered really wholesome, then it must be Cheryl Ladd. This star has the appeal of whatever is meant by the word, 'nice and beautiful'.

If I want to hazard a description of the other Angels, then Farrah would be the most sexy followed by Tanya Roberts and Shelley Hack. Jaclyn Smith was good to look at while Kate is just the girl next door.

I was looking through the WWW and only these Cheryl photos fit my description of 'nice'.

If I want to hazard a description of the other Angels, then Farrah would be the most sexy followed by Tanya Roberts and Shelley Hack. Jaclyn Smith was good to look at while Kate is just the girl next door.

I was looking through the WWW and only these Cheryl photos fit my description of 'nice'.

Labels:

Actresses

It's 29 February Today-Leap Year 2012

Well, as in all leap years, this day props up. Those who have 29th February as their birthdays certainly saves more money as they celebrate less much to their dismay, red-letter day or not.

Remember the movie,'Leap Year' starring the beautiful Amy Adams?

In the role of Anna Brady, Amy travels to Dublin, Ireland to propose to her boyfriend Jeremy on February 29, leap day, because, according to Irish tradition, a man who receives a marriage proposal on a leap day must accept it.

Interesting tradition if they still practise it.

Wonder what would happen if it is a Malaysian tradition?

Would that make for unhappy couples every 4 years?

Labels:

Red Letter Day

Gentings-A Foothold in Banking

Genting Berhad has now gone into banking; albeit in a small way, for now and not at home.

Its maiden banking investment via its unit Vista Knowledge Pte Ltd is a 20% stake is in CIMB Group Holdings Bhd's investment banking advisory joint venture in Sri Lanka called CIMB Pte Ltd.

With Genting's entry, CIMB now holds a 45% stake in the JV (from 51% previously), while its two Sri Lankan partners — Alex Lovell and Reshani Dangalla — own 20% and 15%, respectively.

Last August, CIMB had formed a partnership with Lovell and Dangalla to establish an investment banking and corporate advisory presence in Sri Lanka. Shareholders had committed up to US$2 million for the venture.

Let us see how this investment can be spun into gold for the Genting group and its shareholders.

Labels:

Stocks

February 24, 2012

BAT Recovers on Last Minute Heavy Buying

It is not everyone's risk appetite to buy into a full lot of BAT at RM52.56 per share.

So, when you see a 100,000 share purchase or 100 lots done at this price, it is really a big cash outlay. Estimated gross payment will top RM5.2 million.

I guess a foreign fund came in to take out this tranche.

The highest price it went up to recently was RM54.00.

Today, BAT went up to RM52.64 before retreating to end at RM52.56.

Is something burning in BAT that is going to make minority shareholders stir crazy?

That, we have to see.

Labels:

Stocks

February 23, 2012

The Greek Tentacles are Here

Talk about globalisation and the effects will be felt from now on.

While the formal economy can parade all kinds of cosmetic numbers to shore up support for the government and the stock market momentarily,you cannot mickey mouse with the man in the street.

Go to the wet market and you can feel the gloom and impending doom. Ask the nasi lemak seller hawking in the byways and she tells you she used to sell 6 kilos per day and now even with only a reduced 3 kilo of rice, there is a visible lack of sustained buying.

Where have all the buyers gone?

I guess every one is cutting back. In spite of the 2 million odd foreign workers here, the lack of demand for cooked food at the stalls is alarming.

I believe every one is cooking at home or eating bread which is cheaper in comparison.

The crunch is coming to the informal sector. Very soon, the put on cosmetization of numbers from the formal sector will peel off and turn ugly.

As the Eurozone rolls back its demand for our commodities,the Greek debacle will be at our doors soon and this time it is no Trojan horse!

How sad. As they say, "In times of crisis, cash is king".

So, hold on to your cash, avoid unnecessary expenditure and buy the cheaper alternative to stretch your ringgit.

Pray, we get out of this economic black hole.

While the formal economy can parade all kinds of cosmetic numbers to shore up support for the government and the stock market momentarily,you cannot mickey mouse with the man in the street.

Go to the wet market and you can feel the gloom and impending doom. Ask the nasi lemak seller hawking in the byways and she tells you she used to sell 6 kilos per day and now even with only a reduced 3 kilo of rice, there is a visible lack of sustained buying.

Where have all the buyers gone?

I guess every one is cutting back. In spite of the 2 million odd foreign workers here, the lack of demand for cooked food at the stalls is alarming.

I believe every one is cooking at home or eating bread which is cheaper in comparison.

The crunch is coming to the informal sector. Very soon, the put on cosmetization of numbers from the formal sector will peel off and turn ugly.

As the Eurozone rolls back its demand for our commodities,the Greek debacle will be at our doors soon and this time it is no Trojan horse!

How sad. As they say, "In times of crisis, cash is king".

So, hold on to your cash, avoid unnecessary expenditure and buy the cheaper alternative to stretch your ringgit.

Pray, we get out of this economic black hole.

TASCO-Buyers' Reaction

Early morning trading pushed the prise of this logistics company to RM1.94 before the share retreated to RM1.87. There is not really many buyers for this stock even though dividend has gone up to 10%.

A cursory analysis shows the biggest lot done is 3,0000 shares, indicating very small buyers are nibbling on the counter.

I think TASCO is a good stock to have in one's portfolio if it continues with its profit and dividend performance. I am also incline to believe that the Malaysian-Japanese management is doing one fine job efficiently in a challenging sector.

TASCO ended at RM1.90 for a 5 sen gain.

Labels:

Stocks

February 22, 2012

Foreign Land Deals-Silly Risk Taking?

Investing in land is a very good move towards developing a nest-egg. Remember, location of your land is very important if it is to appreciate in value.

Strangely, many Malaysians have invested much of their hard-earn money in overseas property from USA, Australia,UK to Canada.

There were a number of issues with regard to these overseas land investment. Some people are of the view that this type of investment is illegal and disallowed by Bank Negara Malaysia. A few years back, a local company dealing with UK land was in the lime-light. This land investment was advertised widely on Malaysian radio stations then but I do not know whether the issues were amicably resolved with BNM.

Buying land overseas is very risky. You do not know the laws in that foreign country. You can likely fell prey to sundry risks from illegal activities to misrepresentation. There are loop-holes just like what Edgeworth took advantage of, for their own nefarious leverage purposes or even those that constitute downright cheating of the gullible.

In many overseas land sales, foreign buyers have been duped to buy non-residential or commercial land with the most remote hope that it will be converted in due time. Sadly, not all such lands may be allowed to be converted and may be land to be reserved for 'green lungs'. After all, agents are just interested in their commision and not in after-sales service. They convince you to get your sale in grand style by giving you a hard talk,lunch at a 5-star restaurant as well as complimentary shopping vouchers. So, caveat emptor when approached by any such agents.You may just be the 'sucker' that they are waiting for!

When I read about the plight of Malaysians who fell prey to the Canadian land scheme sold through Edgeworth Properties, I remembered all too clearly my experience with one such company a few years back.

I do not know about anyone getting super returns from their risky investments but my investment forays overseas have been bitter sweet,at best. My investment in an overseas insurance policy in an off-shore facility was disappointing and that pertaining to an Australian scholarship trust was really not worth the while.

A friend of mine who invested in a piece of land in Florida had so much anxiety woes that he visited the land physically in the USA and seeing that there was no' safety net' in the investment, he sold it. Thank God, he did it before the sub-prime fiasco.

Some people are really gutsy. Investing RM750,000 in parcels of land overseas through dubious companies and agents.They dared to invest in the 'unknown' overseas and yet not invest in blue chips on Bursa KL or land in their back yard in Malaysia.These are definitely less risky, for sure!

I wonder why the so called investors are attracted to the remote, 'potential gains' from such land purchase overseas?

Gullibility, again, financial adventurism or just plain silly greed.

Strangely, many Malaysians have invested much of their hard-earn money in overseas property from USA, Australia,UK to Canada.

There were a number of issues with regard to these overseas land investment. Some people are of the view that this type of investment is illegal and disallowed by Bank Negara Malaysia. A few years back, a local company dealing with UK land was in the lime-light. This land investment was advertised widely on Malaysian radio stations then but I do not know whether the issues were amicably resolved with BNM.

Buying land overseas is very risky. You do not know the laws in that foreign country. You can likely fell prey to sundry risks from illegal activities to misrepresentation. There are loop-holes just like what Edgeworth took advantage of, for their own nefarious leverage purposes or even those that constitute downright cheating of the gullible.

In many overseas land sales, foreign buyers have been duped to buy non-residential or commercial land with the most remote hope that it will be converted in due time. Sadly, not all such lands may be allowed to be converted and may be land to be reserved for 'green lungs'. After all, agents are just interested in their commision and not in after-sales service. They convince you to get your sale in grand style by giving you a hard talk,lunch at a 5-star restaurant as well as complimentary shopping vouchers. So, caveat emptor when approached by any such agents.You may just be the 'sucker' that they are waiting for!

When I read about the plight of Malaysians who fell prey to the Canadian land scheme sold through Edgeworth Properties, I remembered all too clearly my experience with one such company a few years back.

I do not know about anyone getting super returns from their risky investments but my investment forays overseas have been bitter sweet,at best. My investment in an overseas insurance policy in an off-shore facility was disappointing and that pertaining to an Australian scholarship trust was really not worth the while.

A friend of mine who invested in a piece of land in Florida had so much anxiety woes that he visited the land physically in the USA and seeing that there was no' safety net' in the investment, he sold it. Thank God, he did it before the sub-prime fiasco.

Some people are really gutsy. Investing RM750,000 in parcels of land overseas through dubious companies and agents.They dared to invest in the 'unknown' overseas and yet not invest in blue chips on Bursa KL or land in their back yard in Malaysia.These are definitely less risky, for sure!

I wonder why the so called investors are attracted to the remote, 'potential gains' from such land purchase overseas?

Gullibility, again, financial adventurism or just plain silly greed.

Labels:

Investment and Annuity

TASCO-Better Net Profits and Dividends

TASCO officially announced its results for the full fiscal year,paying good dividends of another 12.9%.

Performance has also improved. For the full year ending 31 Dec 2011, TASCO's revenue rose to RM469,211 million which is 5.5% better that that achieved in the corresponding period ending 2010 of RM443,362. Profit after tax for the period was RM34,676 million,almost 40% of that attained in 2010 of RM24,776 million. Basic earnings per shares has also risen to 34.59 sen from 24.78 sen in 2010.In terms of dividends, the dividend declared for the current year is 12.90% where 1.3% is tax-exempt while 11.6% is taxed at 25%,effectively translating net dividend to 9.13%. This is better that 9.3% gross declared in 2010.

The last quarter results, though, was lower than that achieved in the corresponding quarter in 2010.Revenue shrunk to RM113,870 million, RM10.8 million lower than RM124,692 million chalked up in 2010. This is equivalent to a 8.6% fall. Thankfully, net profit has been higher at RM13,963 million as compared to RM8,471 million registered in 2010. This is equivalent to a spectacular improvement of 65%.

Let us now look at TASCO's quarter results thus far.

Though revenue is so much lower than in 2010, net profit earnings per share, dividend (12.90%) and NTA (RM2.41)have been good.

Dividend-wise, this year has the best yield thus far ;comparing to the low pay-out of 7% in 2009 and 9.1% in 2010.

If the yearly and quarterly revenue is any indicator, the logistics industry continues to be challenging for TASCO though profits has indeed improved tremendously. Whether the industry can still support such a profit performance is very much dependent on both the global and domestic economy.

Performance has also improved. For the full year ending 31 Dec 2011, TASCO's revenue rose to RM469,211 million which is 5.5% better that that achieved in the corresponding period ending 2010 of RM443,362. Profit after tax for the period was RM34,676 million,almost 40% of that attained in 2010 of RM24,776 million. Basic earnings per shares has also risen to 34.59 sen from 24.78 sen in 2010.In terms of dividends, the dividend declared for the current year is 12.90% where 1.3% is tax-exempt while 11.6% is taxed at 25%,effectively translating net dividend to 9.13%. This is better that 9.3% gross declared in 2010.

The last quarter results, though, was lower than that achieved in the corresponding quarter in 2010.Revenue shrunk to RM113,870 million, RM10.8 million lower than RM124,692 million chalked up in 2010. This is equivalent to a 8.6% fall. Thankfully, net profit has been higher at RM13,963 million as compared to RM8,471 million registered in 2010. This is equivalent to a spectacular improvement of 65%.

Let us now look at TASCO's quarter results thus far.

Though revenue is so much lower than in 2010, net profit earnings per share, dividend (12.90%) and NTA (RM2.41)have been good.

Dividend-wise, this year has the best yield thus far ;comparing to the low pay-out of 7% in 2009 and 9.1% in 2010.

If the yearly and quarterly revenue is any indicator, the logistics industry continues to be challenging for TASCO though profits has indeed improved tremendously. Whether the industry can still support such a profit performance is very much dependent on both the global and domestic economy.

Labels:

Stocks

February 20, 2012

TASCO-Weak Holders, Tired Holders

After a few days of stimulating buying, TASCO is now taking a breather.

Just like the marathon runner, there are times you paced and there are times you may spurt.

So TASCO is now at an even keel as far as demand is concerned as weak and tired sellers sell down. It is definitely a buyer's market for this counter today but volume is small at only 30,000 shares.

An interesting question to ask is: Why was there volume from RM1.70 to RM1.90? Random board walk or something hidden under the corporate sheets?

Tasco is trading two sen down at RM1.88 now. Interesting number by Chinese geomancy,right?

At the end of trading, TASCO fell 5 sen to RM2.85.

Is there still a 'Crouching Tiger' and 'Hidden Dragon' somewhere in TASCO?

Just like the marathon runner, there are times you paced and there are times you may spurt.

So TASCO is now at an even keel as far as demand is concerned as weak and tired sellers sell down. It is definitely a buyer's market for this counter today but volume is small at only 30,000 shares.

An interesting question to ask is: Why was there volume from RM1.70 to RM1.90? Random board walk or something hidden under the corporate sheets?

Tasco is trading two sen down at RM1.88 now. Interesting number by Chinese geomancy,right?

At the end of trading, TASCO fell 5 sen to RM2.85.

Is there still a 'Crouching Tiger' and 'Hidden Dragon' somewhere in TASCO?

Labels:

Stocks

The Flight of BAT

Yes, BAT has done it again.

After some yoyo-yoyo motion, it took off for the final countdown, pushing the price up by an extraordinary RM1.38 to RM53.90, just before the finishing bell.This is ten sen shy of RM54.00. Some 31 lots out of 141 lots were done at this price.

Does that mean, BAT will hover higher tomorrow? Hindsight is 2020.

Let it test the water tomorrow.

Labels:

Stocks

ESSO-Wither Thou?

It's all be quiet on the ESSO front since the announcement and approval of the sale of the 65% controlling stake in Esso Malaysia by its principal, Exxon International Holdings to San Miguel Corporation of the Philippines.

The share price went ballistic on the take-over announcement touching RM5.97 from a low of RM2.85 during the ensuing year. The price of ESS0 has moved up from a low price of RM3.30 during the last 26 weeks to RM4.23 before falling back to the RM3.00 level once more.

It has been gathering strength during the last three months and touched RM3.84 on 17 February.

Today the counter took a fall when the quarterly results was announced. It fell 8 sen to RM3.76. However, there was no panic selling for this blue chip. In fact, for many, it represent a buying opportunity.

Looking at the quarterly results ending 31 December 2011 as compared to the corresponding period last year, it would seem that the net profit has sunk by 2.8 times.Similarly EPS has dropped from 0.45 sen to 12.8 sen.

It can be seen clearly that cost of sales viz-a-viz revenue is very high; equivalent to 96%, causing net profit to deflate to RM120,653 compared to gross profit of RM265,695 attained in 2010.

On a yearly basis,cost of sales viz-a-viz revenue for the current period is also high equivalent to 95% of total revenue.In 2010, this was about 90.7%.

Now that the 'not so good' news is out, what is left will be what has San Miguel in store for minority shareholders

after buying the share at RM3.50.

Esso has now taken a political label since Mirzan Mahathir holds a substantive share in this brewery corporation.Will a de-listing be expected with a boon for minority shareholders?

I think speculation will move the price up. It is a matter of time now.

Labels:

Stocks

TASCO Climbs ON

I have been tracking this stock for a couple of days now and both price and volume have been improving. I still wonder what is the reason for this sudden buying interest. Does anyone has the answer or is it still blowing in the wind?

Today, it ended up 6 sen to RM1.90 after hitting an early trading high of RM1.95. The volume has also increased almost two folds to more than 62,360 shares. (31,400 shares on 17 Feb)

Let us track this stock further to see what is in the offing.

When will there be a near term stabilisation or price hiatus?

Labels:

Stocks

Risk Taking And Fortune Smiles

I had lunch with an old friend today.

We were talking about risk taking. Surprisingly, he told me he is now fully invested in some pieces of choice land and does not own even a single share of Bursa KL.

He was involved in the stock market but fortune has been kind to him finally after many hits and misses. There were times when his heart was in his mouth and he had to cut losses. However, on balance he made a huge amount of cash just buying on the lows and exiting on the highs. That was life-changing for him!

Reflecting on this true story, I know that many among us, myself included, almost had it but has since lost it all as lady luck would not shine on us.

Life is short and there are many not given second chances. With meager resources, as age catches up,risk taking will be the furthest thing from our minds.

As we become more cautious and careful, we will become more risk averse.

As such, the chance of making it in a great way becomes even more remote.

Calculated risks and lady luck will favour those who take risks.

Are you that risk taker?

February 19, 2012

Leona Lewis-A Fantastic Discovery

I accidentally stumbled on the old 2006 X Factor competition videos while looking for some Whitney Houston videos on You-tube. And I found Leona Lewis. Yes, this is about 6 years too late!

Though raw and unpolished as a star diamond, she chalked up success after success on every succeeding week of the show.

I think with the current loss of Whitney, Leona will be one the the replacement for better things yet to come.

Superb voice control and showmanship.

What a find!

Enjoy these videos.

I'll be There

The First Cut is the Deepest

Summertime

Chiquitita

Sorry Seems to be the Hardest Word

Over the Rainbow

Bridge Over Troubled Waters

Lady Marmalade

Could it Be Magic?

I Have Nothing

I Will Always Love You

A Million Love Songs

All by Myself

A Moment like This

Without you

Leona the Journey

Though raw and unpolished as a star diamond, she chalked up success after success on every succeeding week of the show.

I think with the current loss of Whitney, Leona will be one the the replacement for better things yet to come.

Superb voice control and showmanship.

What a find!

Enjoy these videos.

I'll be There

The First Cut is the Deepest

Summertime

Chiquitita

Sorry Seems to be the Hardest Word

Over the Rainbow

Bridge Over Troubled Waters

Lady Marmalade

Could it Be Magic?

I Have Nothing

I Will Always Love You

A Million Love Songs

All by Myself

A Moment like This

Without you

Leona the Journey

Labels:

Melody

February 18, 2012

Almost Like Falling in Love

If you have seen the Broadway play, "Brigadoon" or its film version, you will remember the haunting melody of the song "Almost Like Falling in Love."

Here is the rendition of that song by the legendary Nat King Cole.

Enjoy.

Here is the rendition of that song by the legendary Nat King Cole.

Enjoy.

Labels:

Melody

February 17, 2012

TASCO-Growing Demand for the stock

TASCO is a logistics enterprise. Incorporated in 1974, it was listed on the Man Board of Bursa KL in December 2007. It is a subsidiary of Nippon Yusen Kabushiki Kaisha, a global Fortune 500 company. TASco has more than 30 branches in Malaysia and employs about 1,000 people. Its services covers air, sea and land transportation. It serves as a one stop logistics centre to handle both domestic and international shipments for the customers.

Let us look at some of its published indices.

Revenue for TASCO has been impressive except for small dips in 2003,2005,2007 and 2009.

Similarly, PATAMI slid in the years 2003,2004,2007 and 2009, with the interleaving years posting good profits particularly 2010.

I am not too sure what numbers TASCO has for 2011 until the AGM in June.In fact, we can say that TASCO's performance could be the early warning system of the international economy and also the domestic economy, for better or worse.

For now, the price of the stock is getting some support.

Today, it ended up another 6 sen to RM1.84 on an improving volume of 314,000 shares traded.

Labels:

Stocks

Just Fancy That!

The storm that enveloped Curtin University after it awarded a Doctorate to the wife of the Prime Minister of Malaysia has taken an interesting turn.

The University has now suspended posting on is Facebook to avoid further untoward comments.

What I found laughable in an entry on an internet paper was this comment about awarding a doctorate to.....

This is great! Thank you for tickling my funnybone!

The University has now suspended posting on is Facebook to avoid further untoward comments.

What I found laughable in an entry on an internet paper was this comment about awarding a doctorate to.....

This is great! Thank you for tickling my funnybone!

Labels:

Humour

February 16, 2012

TASCO-Another Dividend Sanctuary

Assuming you are a fundamentalist; and you are looking for some good dividends with some upside in capital gains,TASCO can be an even bet.

Let us look at the trend of the share prices of this Japanese-based logistic company for the last year or so.

The lowest price was in the mid RM1.30's. It moved steadily up towards the RM1.40s and RM1.50s before spiking up 14 sen to RM1.60 on 31 March 2011 on a huge volume of 1.147 million shares. Subsequently, it slid back in the RM1.40-RM 1.50 level in June and July.

In August, there was again a mini spike raising the price to RM1.73. Then, it went south. The nadir price of RM1.36 was reached in September. By November,buying interest came back once more with the price inching back to the RM1.60 level.

In January 2012,prices steadied and by early February began moving upwards again touching the RM1.70-RM1.75 level by 15 February.

Buying volume has been steady and there seems to be no rush to sell as sellers sell into strength.

Let us look at the price movement.

The last dividend paid was an effective 8%. At the current price of RM1.73, you would need to pay RM1,730 for one lot of this share.So, the nominal return is RM80.00 annually. The same amount of return at a bank savings rate at 0.2 is only RM3.46. The differential return of RM80.00 is 23 times more than what you get from a savings account return.

Tasco paid a dividend of an effective 6.25% in 2009.

Tasco closed up 5 sen to a new high of RM1.78 this evening. Volume was fair at 1,460 lots of 100 units.

We will look at the potential and vagaries of this company in another post.

Labels:

Stocks

February 15, 2012

A Lovely Number from the Movie,"The Jilted"

Maybe when you were a young man, you tend to feel more emotional. We adore beauty especially in actresses. And so was it when I first saw beautiful Tan Lan Hua starring in her first movie role in that tear-jerker," The Jilted".

I saw the show one evening at the Capitol Theatre in Malacca.I can bet my bottom ringgit, no one came out of the cinema without shedding tears. It was really sad, very sad. Even my hanky was soaking wet!

I remembered the movie fondly, particularly some of the songs.

This is a clip of the romantic lovers in a beautiful song setting before tragedy struck in the movie.

The song is called "I'm By Your Side".

Lovely number.

I saw the show one evening at the Capitol Theatre in Malacca.I can bet my bottom ringgit, no one came out of the cinema without shedding tears. It was really sad, very sad. Even my hanky was soaking wet!

I remembered the movie fondly, particularly some of the songs.

This is a clip of the romantic lovers in a beautiful song setting before tragedy struck in the movie.

The song is called "I'm By Your Side".

Lovely number.

Labels:

Movies

Odd Lot Trading: The Buyer's Trap

I never felt cowered or even cheated when I first faced this situation.

I was then trading odd-lots in DRB-Hicom through my remisier. My remisier contacted me shortly after I gave the order to buy. She told me only one unit of the share was sold to me out of the number of shares I ordered. This put me into a fix as what could I do with one share. I needed more. So, I had no choice but to take the seller at his price which was at least 50 sen higher. It did not really have much effect in the absolute sense to me as I was buying only a small number of units.

I am now on my own doing e-trading; keying in my own quotes. As such, I could see the way the stock has been traded on this odd-lot counter with the seller having the upper hand to manipulate the price of the share.

When the market opened,I put in a competitive bid for BIMB. My bid was RM2.17 while the seller's bid was RM2.83. The next time I looked at my trade pending status,I saw only one share was matched. This went on until the market break off for lunch.If I do not buy any more shares of this counter; I will be saddled with RM28 as brokerage charge, RM1 for stamp duty and a couple of sens for clearing fees. This will make this one share,one of the most expensive to date.

I had to get out of this trap. So, I placed a small number of units to be priced at RM2.83-the seller's price. To my consternation,some seller gave their shares to me at RM2.50. That saved me some money- about 30 sen more for each unit.

Then, I took a buy position ahead of the bargain-hunting herd at RM2.19. Again this seller gave me one unit at RM2.19; hoping I will buy all that I wanted at RM2.83.

For me, I thought that he will give in to me at the dying minutes of the day if he is desperate to unload, as he would have to pay high brokerage for such a small trade if he didn't. Strangely, he did not budge. Apparently,if he had sold the same counter on the main board, he need not pay much brokerage when he trades additionally on the odd-lot counter for the same share. That must be the explanation for his reluctance to surrender to the buyer's price.

For me, my quick thinking has saved the day and I did not have to pay a higher price for the shares bought. This was my sense of consolation.

So, if you are trading on the odd lot counter, beware of this trap that sellers set up to bait you to buy their shares at their bidding prices!

I was then trading odd-lots in DRB-Hicom through my remisier. My remisier contacted me shortly after I gave the order to buy. She told me only one unit of the share was sold to me out of the number of shares I ordered. This put me into a fix as what could I do with one share. I needed more. So, I had no choice but to take the seller at his price which was at least 50 sen higher. It did not really have much effect in the absolute sense to me as I was buying only a small number of units.

I am now on my own doing e-trading; keying in my own quotes. As such, I could see the way the stock has been traded on this odd-lot counter with the seller having the upper hand to manipulate the price of the share.

When the market opened,I put in a competitive bid for BIMB. My bid was RM2.17 while the seller's bid was RM2.83. The next time I looked at my trade pending status,I saw only one share was matched. This went on until the market break off for lunch.If I do not buy any more shares of this counter; I will be saddled with RM28 as brokerage charge, RM1 for stamp duty and a couple of sens for clearing fees. This will make this one share,one of the most expensive to date.

I had to get out of this trap. So, I placed a small number of units to be priced at RM2.83-the seller's price. To my consternation,some seller gave their shares to me at RM2.50. That saved me some money- about 30 sen more for each unit.

Then, I took a buy position ahead of the bargain-hunting herd at RM2.19. Again this seller gave me one unit at RM2.19; hoping I will buy all that I wanted at RM2.83.

For me, I thought that he will give in to me at the dying minutes of the day if he is desperate to unload, as he would have to pay high brokerage for such a small trade if he didn't. Strangely, he did not budge. Apparently,if he had sold the same counter on the main board, he need not pay much brokerage when he trades additionally on the odd-lot counter for the same share. That must be the explanation for his reluctance to surrender to the buyer's price.

For me, my quick thinking has saved the day and I did not have to pay a higher price for the shares bought. This was my sense of consolation.

So, if you are trading on the odd lot counter, beware of this trap that sellers set up to bait you to buy their shares at their bidding prices!

Labels:

Stocks

February 14, 2012

Cash Call from RCE

Will it be Worth Buying the RCPS?

Looks like this could be a year of cash calls.

Eye-balling many unaudited results announced lately, most seems to be on the downslide in terms of profits.

This year, we have already been informed that BJFoods is asking for additional capital due possibly to their foray into Indonesia and the need for more operating capital for running the newly acquired Starbucks franchise.

So, what is RCE asking for?

There is a bonus issue of 1:2 as well as an issue of redeemable convertible non-cumulative preference shares (RCPS) of 10 sen each, on the basis of two RCPS for every five shares held after the proposed bonus issue.

The exercise is undertaken to repay bank borrowings, working capital-related purposes and to reward its shareholders.

Total gross proceeds from the RCPS rights from the exercise is estimated to be RM178.39mil to RM182.10mil dependent on the going price of RCE after the bonus issue.

The current price of RCE is 54 sen. With the bonus issue, the possible price of each RCE share will be about 32 to 33 sen ex-all.

Labels:

Stocks

Valentine's Day

It's that day again when hearts go all gooey, hoping for roses and chocolates.

For many receiving a Valentine card would have sufficed. Lovers will find this day of critical importance to make their loved ones know of their feelings.

But not many find joy or love on this day dedicated to romantic love. Sad because of unrequited love; sad because it is only a crush...

Where are you, St Valentine?

That's Amore

For many receiving a Valentine card would have sufficed. Lovers will find this day of critical importance to make their loved ones know of their feelings.

But not many find joy or love on this day dedicated to romantic love. Sad because of unrequited love; sad because it is only a crush...

Where are you, St Valentine?

Labels:

Perspectives

Unforgettable Kuch Kuch Hota Hai

If you have but one Hindi film to see in your life,make it "Kuch Kuch Hota Hai" which literally means 'Somethings Happen'

Sharukh Khan, Rani Mukherji and the delectable Kajol bring wonderful chemistry to the silver screen. Just listening to the haunting melody of Kuch Kuch Hota Hai can make your day.

Here are the lyrics and the clip. Have fun!

Tum paasse aye, Tum paasse aye

Yun Muskurayee, Tum nena jane kya

Sapne de khaye, Aabto mera dil

Jaane ka sota hai, Kya karoon ha yeKuch kuch hota hai(Repeat again)

[ Lyrics from: http://www.lyricsmode.com/lyrics/s/shah_rukh_khan/kuch_kuch_hota_hai.html ]

NaJaane kaisa eh saas hai

Bujhti nahi hai, Kya pyaass hai

Kya nasha es pya ro kya

Mujpe sanam , Chaane laga

Koina Jaane, Kyun Chain Hota Hai

Kya Karoon haye, Kuch Kuch Hota Hai

Tum paasse aye, Tum paasse aye

Yun Muskurayee, Tum nena jane kya

Sapne de khaye, Aabto mera dil

Jaane ka sota hai, Kya karoon ha yeKuch kuch hota hai

Sharukh Khan, Rani Mukherji and the delectable Kajol bring wonderful chemistry to the silver screen. Just listening to the haunting melody of Kuch Kuch Hota Hai can make your day.

Here are the lyrics and the clip. Have fun!

Tum paasse aye, Tum paasse aye

Yun Muskurayee, Tum nena jane kya

Sapne de khaye, Aabto mera dil

Jaane ka sota hai, Kya karoon ha yeKuch kuch hota hai(Repeat again)

[ Lyrics from: http://www.lyricsmode.com/lyrics/s/shah_rukh_khan/kuch_kuch_hota_hai.html ]

NaJaane kaisa eh saas hai

Bujhti nahi hai, Kya pyaass hai

Kya nasha es pya ro kya

Mujpe sanam , Chaane laga

Koina Jaane, Kyun Chain Hota Hai

Kya Karoon haye, Kuch Kuch Hota Hai

Tum paasse aye, Tum paasse aye

Yun Muskurayee, Tum nena jane kya

Sapne de khaye, Aabto mera dil

Jaane ka sota hai, Kya karoon ha yeKuch kuch hota hai

Labels:

Movies

February 13, 2012

There was a Moment in Time......

For a moment in time, Whitney was with us. She leaves us with more sweet that bitter memories. Here is her rendition of 'The Greatest Love of All".

Labels:

Melody

Celine Dion In Concert

Celine in concert is an experience. If only, it is the real thing. However, a HD video of the event is second best.

Here, enjoy!

Here, enjoy!

Labels:

Melody

Supermax Corporation -New Target Price

Some More Upside

Fresh after its recent 1:1 bonus issue, Supermax Corporation (Supermax)continues to get market support. Supermax is now trading ten sen down at RM2.09 from the ex-price of RM2.19.

A research house, OSK Research continues to be bullish about the rubber gloves sector,selecting Supermax as its top pick. The potential target price envisaged is RM2.75.

Why Supermax?

OSK likes the company because of its attractive valuation and the fact that it operates in a recession-resilient industry.

While there have been isolated cases of bird flu in Asia currently, health care MNCs are beginning to gradually stock up rubber gloves to avoid buying them at "cut throat" price should a pandemic breaks out.

The risks to its upside potential are the continuing high cost of rubber supported artificially by both the Indonesian and Malaysian governments and the rising ringgit.

Thailand has also meanwhile approved a plan to increase the price of locally-grown natural rubber to THB120 (RM11.84)/kg through the Bank of Agriculture and Agricultural Cooperatives-offering soft loans of THB5bn to local agricultural institutes and another THB10bn soft loan to the Rubber Estate Organization, both at zero per cent interest to help them purchase natural rubber from local rubber farmers.

Intervention was necessary because of poor rubber prices arising from the global economic slowdown; the flooding crisis in Thailand which had temporarily suspended its production of automobiles and parts and the slower automotive growth in China which in turn slowed down its purchase of Thai natural rubber and instead had switched to the cheaper Indonesian rubber.

Sans all these support schemes, the natural forces of demand and supply will determine rubber and latex prices.

Latex price are expected to stay above RM7 in the shorter term.

While the scenario is not great, it remains good for Supermax to continue to perform well.

Labels:

Stocks

Betting on BAT

Riding High

Rolling in the Profits

Despite so many anti-smoking campaigns world-wide and exorbitant tax levy, most tobacco company counters continue to go up. Individuals actually find it very hard to own tobacco shares anywhere in the development world. The same is going to happen to Malaysia.

Look at the way British American Tobacco shares are going upwards,it is now very difficult for a retail player to purchase a 1000 shares at today's going price of RM51.50 per share. At best, you would have to cough out RM5,150 for a token 100 units of it.

BAT is certainly a good counter and pays absolutely beautiful dividends. Ask any minority shareholder and he will tell you that the share has been good to him with its bumper dividend pay-out every now and then. I will delve a little bit on BAT's dividend in another posting.

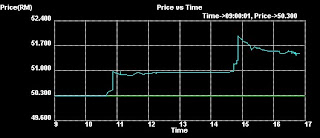

After a lull from the beginning of the year where its shares ranged from just below RM50.00, today is one break-out day. From RM50.30 , it shot passed up to almost touch RM52.00. One lot was done at RM51.98 and another at RM51.90. A dozen lots were contracted at RM51.88 before weak sellers came out from the woodwork to sell the counter down. Before the market ended, massive buying appeared out of nowhere. Some 69,500 shares changed hands during the last hour or so. This is equivalent to 51% of all volume traded.

Price-wise BAT shares have soared today by 2.4%.

Why is BAT flying like crazy?

Is it being bought by institutional buyers from overseas as a proxy to a strengthening ringgit? Or are they bought by local funds, a delayed January effect response?

Maybe another super dividend is in store as BAT has time and again been giving shareholders sweet surprises.

There is also that possibility that a bonus may be given or a share split might be in the offing.

Finishing Strong! at RM51.50

Whatever the reason, BAT is one might good counter to watch and to invest.

Labels:

Stocks

February 12, 2012

Ranking for Frequent Blog Site Visits

By chance, I came across the ranking for this blog.

According to Alexa Traffic Ranking, Journaler0203 ranks in position 7,083,989 in terms of visits.

Alexa Web Information Company conducts web site audits.

The most read were posts related to Commissioner of Oath, local stocks, English, social and economic issues.

Interesting world ranking, don't you think?

According to Alexa Traffic Ranking, Journaler0203 ranks in position 7,083,989 in terms of visits.

Alexa Web Information Company conducts web site audits.

The most read were posts related to Commissioner of Oath, local stocks, English, social and economic issues.

Interesting world ranking, don't you think?

Labels:

Milestones

Is 1Malaysia in Troubled Waters?

When PM Najib took over the helm of government, he wanted to make his mark amidst the currents of ITC technology,globalisation and the realities of the multi-racial and multi religious Malaysian society.

So, he conceptualised 1Malaysia. But what is in this capsule called 1Malaysia? Najib has to make practical meaning to the citizens from many divides. It cannot be the equivalent to the trade-mark of DAP's Malaysian Malaysia, no matter how alike like peas in a pod, they are.

So, what he has done has been to add bits and pieces to make it relevant.

Somewhere, along the line, the Rukun Negara, the national unifying ethos, had to take a back-seat.

So, a concoction of facets of what 1 Malaysia is and can be made tangible started to take shape.

Like the proverbial Blind Men and the Elephant, every thinking Malaysia tried to put a handle on the nebulous 1 Malaysia concept and how it applied to him in his life and his nation.

Obviously, the people who are optimists, will see the good in Najib's concept while the naysayers will find fault with it with every drop of a cap, hat or songkok.

The 1 Malaysia concept includes everything from 1Menu,1 Kedai Malaysia,PR1M Housing,Br1M(Citizen Grants),1Malaysia Student Grants. 1 Malaysia Book Coupons and more to come.

The more controversial of his 1Malaysia concept had to do with religion. As a 1Malaysia PM, he made it a point to attend cultural and religious festivals as well as to be seen with ICT and youths.

So, PM waded into unknown waters when he attended the recent Taipusam religious celebrations on 7 February. The religious authorities have now contraindicated that the PM should not attend such functions as it meant he is sacrifying his Muslim faith.

This would likely be a 'storm in a teacup' if it can be contained. Can he enlist Khir Baharom to do the needful?

Let us see how PM will dismantle this barrage of criticisms against him from the religious quarter; or maybe he can continue being silent,as always.

Labels:

Perspectives

Subscribe to:

Posts (Atom)