|

| A 6 fold return |

Based of the price of the shares and the subsequent bonus and rights issue, that shareholder will be having RM113,875 worth of LPI shares. Add the dividends paid of RM39,750, it means that for the shareholder would have pocketed RM153,625 if he sold all his shareholdings on the last trading day of 2011. The rights issues quantum expended was only RM10,730 thus far. On a 17 year period, the annualised returns worked out to some 27.3% returns.

In 2010, a bonus issue of 1:2 and a rights of 1:10 at RM7.00 were issued and traded. A shareholder with 1000 shares will have to pay RM700 to get 100 shares. With the bonus issue of 500 shares thrown in, it means he will have 1,600 shares.

When the shares traded in September, from RM18.00 it went down to RM11.94 to accommodate the bonus issue. At RM12.00, this shareholder would have RM19,200. It you deduct RM700 from this value, the net benefit for the shareholder will be RM500 in September 2010.

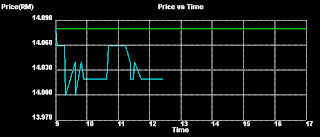

Today at RM14.00, the worth of the shares for that shareholder will work out to RM21,400 (after deducting for the RM700 for the rights value).

An investor who bought into the share at RM18.00 cum rights would have earn RM3,700 as of today. That will work out to almost 20%. Add the special dividends when the shares go ex on 20 January, it will mean a return of 19.2% per annum. This is certainly better compared to the 3% and below fixed deposit regime in the banks today (by 6 folds!)

LPI closed 10 sen down at RM13.98.