|

| Solid Defense |

At this juncture, I do not know how much of motor insurance does LPI has in its portfolio. I will certainly be researching on this as it will certainly impact upon the improving profit of LPI.

When Teh Hong Piow started London Pacific Insurance (LPI), not many expect it to move up up the way it did.

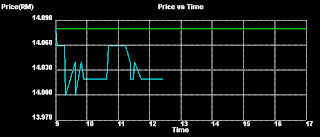

In 2010, it gave a bonus of one for every two shares held and a rights issue of RM7.00 for every 10 shares held. At that time, the share was trading at about RM13.00. It exed about RM11.80 and hovered beyond RM12.00 in a short time.

Beginning January 2011, it elevated itself to RM14 and subsequently went south by the middle of January and thereafter slid into the RM12.00-13.00 price range. There was an upsurge to RM14.00 again during the month of July. It then went down once more right up to the RM12.00 price cohort. By October it was in the RM11.00 cohort.

From December is moved up to build a base around the RM13.00 range before the run off to RM14.00 when it touched RM14.10 yesterday(10 January 2012). This represented a 22 sen up from the day before.

Today, it is building a base above RM14.00 until the stock goes ex-50 sen special dividend on 20 January.

|

| Good entry point or what? |

No comments:

Post a Comment