March 01, 2012

Digi-Another Ascent up the Price ladder

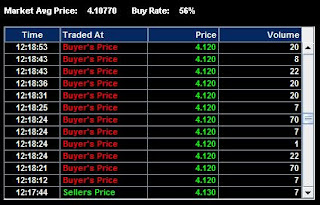

After that last hurrah many weeks back when the shares of Digi rose in volume and tacked in up to a good price of RM4.32, it has started moving up again this morning from the RM4.00 doldrums.

Looking at the strength of the buying support,it looks like it is sustainable this time around.

Hopefully, it may soon breached the RM4.40 that analysts have been predicting so that everyone investing in Digi of late can go for an Anchor or a Carlsberg in celebration.

At the end of trading, Digi closed at RM4.12 for an 8 sen gain. Volume was at 6.9 million shares.

Labels:

Stocks

Sime Made it into the Double Digit

After struggling from corporate fumbles, Sime Darby finally made it to the roost moving beyond RM10.00 in early trading and sustained up to noon.

Volume was heavy for a heavyweight. My best guess is it is local institutional buying or foreign funds may have waded in the snap up shares in Sime.

It is currently trading above RM10.10 and could sustained at this price range until the finish if no weak holders come in to spoil the fun.

Labels:

Stocks

The Book or the Movie?

I have read the book, "The Girl with the Dragon Tattoo" just days before I saw the movie.

One thing I can tell you. After reading the book, whatever suspense left in the movie just got lost. Pity that it followed the book too closely. Except for the last part where they decided not to go to Australia and re-write the subplot that Harriet was actually Anita residing in London, the movie lacks plenty after the plot is gone. Nothing in the movie is shocking.

Otherwise, I think Rooney Mara played the role of Lisabeth Salendar to a T. Craig was his usual glummy self, hardly venturing a smile.

One thing I can tell you. After reading the book, whatever suspense left in the movie just got lost. Pity that it followed the book too closely. Except for the last part where they decided not to go to Australia and re-write the subplot that Harriet was actually Anita residing in London, the movie lacks plenty after the plot is gone. Nothing in the movie is shocking.

Otherwise, I think Rooney Mara played the role of Lisabeth Salendar to a T. Craig was his usual glummy self, hardly venturing a smile.

Labels:

Movies

UAC-Slightly under the Weather

UAC is what they termed as an old horse counter. As the premier cement board manufacturer, it has seen dwindling fortunes the last few years. As its performance and profits is contingent on the construction industry, its fortune rises and ebbs with the ups and downs of the construction sector.

Let us look at the revenue of UAC for the last few years from 2006 to 2010.

The revenue numbers shows an up and down trend with the best year being 2010. 2006 and 2008 also showed good revenue yield.

For profit before tax, UAC had the best year in 2006 and the worst year in 2008.

For after tax figures, UAC did best in 2006.

Let us now focus on dividend yield.

The best year for dividends was 2008 when UAC gave out a gross of 26 sen plus a non tax 6 sen. Dividend for 2007 was a good 30 sen.

For 2010, it gave out 24 sen gross,a fair dividend given the more challenging construction industry.

So, can we say that UAC is a good dividend counter to invest in?

In effective rate, UAC paid net dividend of 25.5 sen net in 2006;22.5 sen in 2007;16.5 sen in 2008,19,5 sen in 2009 and finally 18 sen in 2010.

On an average basis, if you are holding UAC shares from 2006, you would have secured an average dividend income of 20.4%. This works out to a return of 6.8% per RM1,000 investment.

This is definitely better than putting money into fixed deposits. Then there is that good possibility for capital gains too.

A word of caution, though.

UAC is strictly investor grade and you may not be able to quickly dispose of it in the market as there are very few speculative buyers.

Labels:

Stocks

Turning 60

Today, I turn 60.

Well,most people say it is just a number.

For me, it is a milestone number.

A number to reflect upon - the achievements that one can cherished, the joys to relive once more.

Recollection of good times past; of friends who have helped us get this far. And to those we were blessed to help change their lives; sometimes-forever.

May God bless me with good healthy, happy years ahead.

Amen.

Labels:

Milestones

"Who's That Girl?" in The Artist

This following description aptly sets the tone for the Best film for 2011,"The Artist"

An enthusiastic fan literally bumps into her silent screen hero outside a movie preview. The gracious reaction of the male hero to the lady fan led Peppy to give a kiss on the cheek of George and a new star of 'the talkie' was born at the behest of the now falling silent movie star.

A black and white silent movie (beautiful background music)that is at once reflective of the ups and downs of life.

Wonderful cast of Jean Dujardin, Berenice Bejo,John Goodman,James Cromwell and that darling of a little dog!

I enjoyed this black and white movie very much.

The Artist really is worthy to win the golden Oscar statute of Best film for 2011.

An enthusiastic fan literally bumps into her silent screen hero outside a movie preview. The gracious reaction of the male hero to the lady fan led Peppy to give a kiss on the cheek of George and a new star of 'the talkie' was born at the behest of the now falling silent movie star.

A black and white silent movie (beautiful background music)that is at once reflective of the ups and downs of life.

Wonderful cast of Jean Dujardin, Berenice Bejo,John Goodman,James Cromwell and that darling of a little dog!

I enjoyed this black and white movie very much.

The Artist really is worthy to win the golden Oscar statute of Best film for 2011.

Labels:

Movies

February 29, 2012

Can you believe them?

Day in and day out, when the stock market is in an upward direction, we have predictors, forecasters and oraclers telling us their supposedly hindsight 20-20 vision of what target prices a stock should be.

They could be fundamentalists or they could be those chaps operating from waves,candles and charts.

All the same, the have their share of predictions. Could they be believed?

Let us look at some of the stocks they are looking at today and what are their forecasted price in days to come. We must tell ourselves that they are all giving us their forecasts with the grand assumption that the global economic trends remain intact.

Let us look at three investment banks and their forecasts. The banks are Hwang-DBS Vickers,RHB Research and Am Research.

Let us look how they perceived one of South-east Asia's bluest of the blue shares-Sime Darby.

This stock is trading 25 sen up today at RM9.96.

Hwang opines that it will likely go up to RM11.25; RHB Research, being less optimistic, gives it a RM10.55 while Am Research gives it a 5 sen better at RM10.60. If a majority count is made, then Sime should move up to RM10-55-RM10.60. This will be a fair price projection.

Two investment houses recommend Sunway Holdings.

This stock is currently trading at RM2.62. Hwang believes that it can move up to RM3.30 while RHB cautiously reckon it can reach RM3.15.

One other stock is Digi. One investment house(I cannot recall-it could have been CIMB) said it will move up to RM4.40, It is currently settling down at RM4.06. A push of 34 sen and it will have arrived.

Meanwhile, do not expect all these shares to go up like an arrow.

There will be fits and starts, digestion issues, warts and all.

So, be patient!

They could be fundamentalists or they could be those chaps operating from waves,candles and charts.

All the same, the have their share of predictions. Could they be believed?

Let us look at some of the stocks they are looking at today and what are their forecasted price in days to come. We must tell ourselves that they are all giving us their forecasts with the grand assumption that the global economic trends remain intact.

Let us look at three investment banks and their forecasts. The banks are Hwang-DBS Vickers,RHB Research and Am Research.

Let us look how they perceived one of South-east Asia's bluest of the blue shares-Sime Darby.

This stock is trading 25 sen up today at RM9.96.

Hwang opines that it will likely go up to RM11.25; RHB Research, being less optimistic, gives it a RM10.55 while Am Research gives it a 5 sen better at RM10.60. If a majority count is made, then Sime should move up to RM10-55-RM10.60. This will be a fair price projection.

Two investment houses recommend Sunway Holdings.

This stock is currently trading at RM2.62. Hwang believes that it can move up to RM3.30 while RHB cautiously reckon it can reach RM3.15.

One other stock is Digi. One investment house(I cannot recall-it could have been CIMB) said it will move up to RM4.40, It is currently settling down at RM4.06. A push of 34 sen and it will have arrived.

Meanwhile, do not expect all these shares to go up like an arrow.

There will be fits and starts, digestion issues, warts and all.

So, be patient!

Labels:

Stocks

Subscribe to:

Posts (Atom)