Was there a push or was it a genuine buyer at RM34.80? That we may never know for sure.

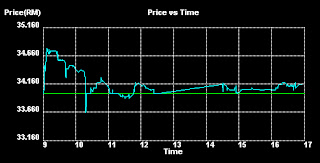

What I saw in the morning session before the EGM scheduled at 2 pm is that buying pressure has receded and bargain hunters are stacking up; pulling prices down. Most stock were done in the RM34.60-RM34.70 price range.

By 11 am, the price of the stock has dipped below RM34.00 for the second time falling as much as 34 sen at once instance.

Now it is just playing limbo rock below the RM34.00 price level and sitting at the price plateau of RM34.00 and some occasional price spurts has brought it to positive territory.

Let us see how it will settle down at the 12.30 trading break.

Looking back,it can be seen that confidence in the stock stayed at an upbeat bias as the stock transcended the psychological RM34.00 mark. Subsequently it see-sawed between RM34.04 and RM34.16 finishing at at RM34.16 for another 16 sen gain. Paltry but significant as the stock has now been approved for splitting.

Ass the time-table goes, the share will go ex on 21 November. Those shareholders who are on the company's register at 5 pm on 23 November will get the divided shares into their respective CDS by day-end.

After that, it will be dependent on market forces and perception of the historical RM0.01 sen share may give Digi a brand new image at the single ringgit league once more.

Let's look forward to Thursday 24 November 2011.

November 08, 2011

Hitting RM34

Somehow I have a gut feeling that someone is benchmarking the stock price of Digi before the split.

Some stock analyst had forecasted that Digi will go ex at RM3.40. So true to form, it burst the banks and headed beyond to RM34.22; pulling back comfortably to perched at RM34.00 at the day's close. As far as the mission is concerned, they did their job pretty well as the price breached RM34.00.

Anything more will be on its own steam.

Tomorrow, at the EGM, the share will officially be endorsed for a share split from its current 10 sen par to become a 1 sen par share. Theoretically, based on today's price, the price of RM3.40 per share brings a honourable premium of RM3.39 sen.

So let us see the price trajectory of this counter until Digi ex-split at the end of November.

Fantastic!

Some stock analyst had forecasted that Digi will go ex at RM3.40. So true to form, it burst the banks and headed beyond to RM34.22; pulling back comfortably to perched at RM34.00 at the day's close. As far as the mission is concerned, they did their job pretty well as the price breached RM34.00.

Anything more will be on its own steam.

Tomorrow, at the EGM, the share will officially be endorsed for a share split from its current 10 sen par to become a 1 sen par share. Theoretically, based on today's price, the price of RM3.40 per share brings a honourable premium of RM3.39 sen.

So let us see the price trajectory of this counter until Digi ex-split at the end of November.

Fantastic!

Labels:

Stocks

YTL Corp-Excitingly mischievous

On the GLC-Non GLC divide, one company continue to up-end almost everyone.

Perhaps Robert Kuok'e empire rule supreme. Perhaps Genting Highland Group is a formidable adversary.

But right there before our very eyes-there is the looming YTL Group helmed by the founder and his financially savvy son.

I was just looking at the reserves and cash in hand of YTL in their latest Annual report 2011 posted on Bursa KL's website this morning.

What I found interesting is that the reserves have been rising rapidly even more dramatic than the current flood waters in Bangkok.

Up to mid-2011,the fixed deposit of YTL has risen by another RM971 million since 2010. Extrapolating forward, before the year is out, additional fixed deposit should have crossed the RM1.2 billion mark by then

Combining deposit and cash in hand and bank balance, the total amount at the disposal of YTL stands close to RM12.24 billion as at mid 2011; and that my friend, is plenty of mucho dinero.

So what does a cash rich company do? Waste it as inflation devour its value? No, besides hedging it against currencies and other investment such as gold , it must do sometime about the cash horde.

As the say, an idle cash horde is a devil's playground and so good old Francis is watching out on how to make more money and more money.

What do you think he can do?

Well, for one-he is waiting for the green-light to build the KL-Singapore high speed train. Then there is always the next phase for his 4G telephony trajectory. As YTL Corp has sold most of its real estate to STAREIT or to YTL Land and Development, it is now a plenary company for strategic takeovers and tactical pursuits.

In the meanwhile,since its Treasury share accumulation is closing to the 7% mark, it may just distribute the shares generously to its loyal shareholders and start accumulating again once they obtain the renewal from its shareholders on 29 November.

The current share price is RM1.50- about the same price when it share split from 1 to 5 shares.

All in all, YTL Corp is proving to be one interesting company to watch.

Perhaps Robert Kuok'e empire rule supreme. Perhaps Genting Highland Group is a formidable adversary.

But right there before our very eyes-there is the looming YTL Group helmed by the founder and his financially savvy son.

I was just looking at the reserves and cash in hand of YTL in their latest Annual report 2011 posted on Bursa KL's website this morning.

What I found interesting is that the reserves have been rising rapidly even more dramatic than the current flood waters in Bangkok.

Up to mid-2011,the fixed deposit of YTL has risen by another RM971 million since 2010. Extrapolating forward, before the year is out, additional fixed deposit should have crossed the RM1.2 billion mark by then

Combining deposit and cash in hand and bank balance, the total amount at the disposal of YTL stands close to RM12.24 billion as at mid 2011; and that my friend, is plenty of mucho dinero.

So what does a cash rich company do? Waste it as inflation devour its value? No, besides hedging it against currencies and other investment such as gold , it must do sometime about the cash horde.

As the say, an idle cash horde is a devil's playground and so good old Francis is watching out on how to make more money and more money.

What do you think he can do?

Well, for one-he is waiting for the green-light to build the KL-Singapore high speed train. Then there is always the next phase for his 4G telephony trajectory. As YTL Corp has sold most of its real estate to STAREIT or to YTL Land and Development, it is now a plenary company for strategic takeovers and tactical pursuits.

In the meanwhile,since its Treasury share accumulation is closing to the 7% mark, it may just distribute the shares generously to its loyal shareholders and start accumulating again once they obtain the renewal from its shareholders on 29 November.

The current share price is RM1.50- about the same price when it share split from 1 to 5 shares.

All in all, YTL Corp is proving to be one interesting company to watch.

Labels:

Stocks

November 03, 2011

Digi Goes North

Today is Friday but European markets looks bright and so it should have some positive effects on Asian markets.

As it goes Digi and Genting took top marks.

From a beginning low of RM32.60, Digi shares, though traded in small tranches, move up steadily after getting traction above RM32.70.

By lunch close, it has added a delightful 68 sen to RM33.16.

Whether it will remain so until the end of trading day is anybody guess.

I will post again at trading's end.

Yes, Digi finished off best but tacked on a handsome 82 sen to finished at RM33.30.

Looks firm this time though there was a spurt to RM33.48 at one point before it pulled back.

As it goes Digi and Genting took top marks.

From a beginning low of RM32.60, Digi shares, though traded in small tranches, move up steadily after getting traction above RM32.70.

By lunch close, it has added a delightful 68 sen to RM33.16.

Whether it will remain so until the end of trading day is anybody guess.

I will post again at trading's end.

Yes, Digi finished off best but tacked on a handsome 82 sen to finished at RM33.30.

Looks firm this time though there was a spurt to RM33.48 at one point before it pulled back.

Labels:

Stocks

November 02, 2011

Dogmatic Digi?

Digi.Com is an interesting counter of late.

Have you watch the nature of its trading for the last ten trading days? Mighty interesting as if big boys are manipulating this counter for some unforseen reason. Real big bucks have been expended to push the counter up and then to leave it fall plumbline at trading’s end.

Digi is an occasional counter, seasonal spurts and falls but mostly getting price traction as time moves on. It is definitely investor-grade stock though day traders could pun it to advantage.

From RM31.00, it has moved surreptiously up the price ladder. Reaching mid-price of RM31.60, it started an erratic pattern-shooting up to RM33.50 only to fell flat and into red territory on the screen.

From 2rd November and today (3rd November), Digi prices have been better bucking the trend in spite of the soft market brought about by the Greek sycophants and their debt problem. Yesterday, it took in a gain of 40 sen to close at RM32.30 while today it posted a 18 sen gain to RM32.48.

Let us watch how this counter will perform until Digi’s EGM on 9 November. Will it heave-ho away tsunami-style or will it take on an incremental softer paced upward price movement?

Also, after price ex-all via its subdivision to 10 shares per share of 1 sen each, will it attract top feeders to move up vigorously at the single dollar level to convert into ardent longer term investors of this supposedly well managed company?

Let us observe the possible trajectory; the spurts, spills, rise and fall, won’t we?

Labels:

Stocks

Hong Leong Bank-The Dreaded VSS

It has to come.

After all, Hong Leong as a financial grouping isn’t blue-eyed for many as it does not have a sparkling image. Apart from being seen as ‘stingy’ from the shareholders’ viewpoint as no door gifts were ever doled out in the best of years at its AGMs, and even bank charges are seen as ‘cut-throat’ for many of its account holders and clients. Moreover, staff morale for ex-EON Bank staff has been going down the chute with numerous resignations in the past months, so it seems.

Today, dear Yvonne Chia, to the chagrin of Hong Leong Bank’s permanent staff has unveiled an exit plan- the much dreaded VSS- a devil in the deep blue sea and a hard place!

Let’s see what is on offer.

The VSS payment formula is based on a VSS multiplicant that ranges from 1.4 (for executives) to 1.6 (for non-executives) multiplied by the length of service (capped at a maximum of 22 years) multiplied by the basic salary or 50 per cent of total monthly salary until retirement, whichever is lower.

In addition, the bank is also offering medical relief of up to RM1, 000, reimbursable for a period of six months from the date of separation, and continuation of housing and motor vehicle loans at staff preferential rates for a period of 12 months from the date of separation.

Final approval of the VSS applications at HLB will strictly be based on business and operational requirements.

So, it’s a take it or leave it.

Or worse, do not take it and you may just get the sack if you are a jack-in-the-box undesirable HLB future material!

Labels:

Stocks

October 29, 2011

Social Hypocrisy- Needing It

As we grow old, we must embrace the nuances of social hypocrisy.

Many people nowadays shun social gatherings because they are absolutely tired of listening to ego tripping by those who claim to be materially successful in life.

A friend related about an incident where someone joined a table of diners only to start talking about his new purchase of a Mercedes. The table crowd suddenly excused themselves and melt away.

However, we cannot do this all the time. We must accept those who we consider our friends in spite of all their bragging, warts and all. A soft humming 'yeah' now and then will help to to neutralize any lopsided conversation. Do not engage and the topic will die a natural death.

Also, changing topics will help to diplomatically shut off the naked pursuit of one upmanship.

Many people nowadays shun social gatherings because they are absolutely tired of listening to ego tripping by those who claim to be materially successful in life.

A friend related about an incident where someone joined a table of diners only to start talking about his new purchase of a Mercedes. The table crowd suddenly excused themselves and melt away.

However, we cannot do this all the time. We must accept those who we consider our friends in spite of all their bragging, warts and all. A soft humming 'yeah' now and then will help to to neutralize any lopsided conversation. Do not engage and the topic will die a natural death.

Also, changing topics will help to diplomatically shut off the naked pursuit of one upmanship.

Labels:

Perspectives

Subscribe to:

Posts (Atom)